Ticker-tape, The Information Age, and the Future of Cryptocurrency

The cryptocurrency market is famous for massive volatility. Unlike the stock market, cycles can be measured in minutes rather than hours. Many stock people shy away from cryptocurrency for this reason (although there are other reasons as well). In fact the stock market has also gotten much faster. This is a natural consequence of how much easier and faster it is to access data. In time all markets - stocks to cryptocurrency - might use artificial intelligence to get ahead of the competition. There was a time not so long ago when stock cycles were measured in days. Very few today are old enough to remember that Wall Street had runners who conveyed stock information that would be written on boards. This is likely the origin of the “Big Board.”

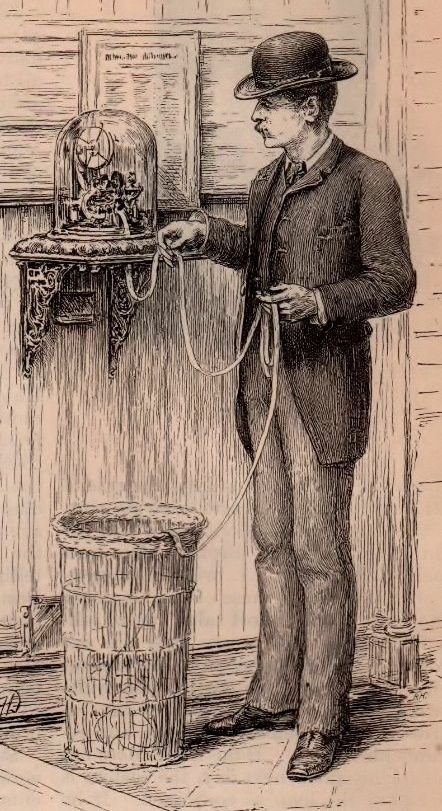

The next era of faster data can be called the ticker tape age (1870-1970), where stock prices were conveyed by telegraph to a stock ticker (which made a ticking noise as it printed prices on a strip of paper). Thomas Edison developed the Universal Stock Ticker in 1869. Using alphanumeric characters, it would print at a rate of one character a second. The text was sent using a special typewriter at the sending end. This was a great advance over Morse code. The ticker would run continuously, and by the end of that century the tickertape machine became a standard feature in offices of NY bankers and brokers. The system had serious faults. At periods of high volume, the ticker could fall behind and leave investors in the dark. While there were many factors leading to the crash of 1929, this period of high trading volume caused many to panic that the crash was even worse than it was.

By the 1930s newer tickers produced text faster, but there was still a 15 or 20 minute delay. By the 1960s, tickers were on the way out. The one thing that remains relatively unchanged is the way information is presented on many electronic boards. There is a company name that is abbreviated (sometimes in creative ways). The volume of shares traded is next, and then comes the price per share. An arrow showing if the latter is higher or lower than the last trade is either an “uptick” or “downtick.” Long spools of used tape could be cut into pieces and tossed out of windows in major cities to give special people a tickertape parade. Starting in the 1920’s, the writing was on the wall regarding the fate of the ticker tape machine. This statement is literally true because projection systems could throw images of a moving ticker on the wall. There were also a range of different quotation systems that were introduced at about this time (some based the telephone). They put pressure on tickers all through the 1930s and 1940s, and by the 1960s there were desktop screens that individuals could use. It would still take time to wire instructions to trade a stock, but over time the process became faster. It is very difficult to day trade when the process could take an hour.

In 1962 AT&T launched the first commercial satellite called the Telstar that would transmit signals between the US and England and France. The nature of the orbit meant that there were only about 20 minutes of communication with each pass, but it gave the US a window to the wider world. The NASDAQ, founded in 1972, was at first designed for quotations only, but soon too up trading and as well. In many ways it blazed a trail that is still being explored today. What killed ticker tape? It was a range of inventions that no one could have seen coming. Those inventions in turn influenced the market in ways that again, no one could understand at the time. With every technological advance market cycles are faster and faster. There is more and more information, some of it might even be correct, available to a wider range of people than ever before. The next question might be what does the future hold?

It is possible to guess:

Cryptocurrency, now largely traded by tech-savvy younger people, might gain very wide acceptance. It might be viewed as a store of value, as a currency, or as a fractional share in a company or invention. Over time different coins might be traded in different ways and using different exchanges.

Over time more people are using the internet for longer periods of time each day. It is not uncommon for people to get up a night to check the internet. If this continues it could make the market more volatile as individuals will be able to react over a longer time frame. If market data can be presented projected on everyday glasses it could have a profound effect on the market.

With every cryptocurrency market bubble more people join the market. Those that stay after a correction might be more likely to ride the waves for the long haul. On the other hand there are those who thrive on the stress of day trading.

There is an almost infinite variety of social platforms that can function using cryptocurrency. Expanding the appeal to increase the reach of a social platform can lead to electronic coins becoming something quite different than something that simply represents value.

History has hard lessons for those who try to predict the future. Only the most imaginative predictions have a chance of coming true. It is likely that all the predictions outlined above will turn out to be wrong to a greater or lesser degree. Who can predict what other inventions might interact with cryptocurrency to change the world?

If you liked the article please vote or subscribe. If you have any ideas about what the future holds please free to comment!

Image from Harper's (8/1885) of a man holding the paper from a tickertape machine at the NYSE.

Hello @murray3 I enjoyed your article and have upvoted. Thank you for visiting my blog.