MenaPay- Crypto Made Easier Than Cash

Introduction:

In this rapidly changing global economy, banking plays a very important role for the growth of individual as well as for the nation. Due to their importance in the financial stability of a country, banks are highly regulated in most countries. If we talk about the definition of banking, in simple words can be defined as The business activity of accepting and safeguarding money owned by other individuals and entities, and then lending out this money in order to earn a profit.

History of Banking:

Banking began with its first prototype banks of merchants of the ancient world, which made grain loans to farmers and traders who carried goods between cities and this system is known as a barter system.This began around 2000 BC in Assyria and Babylonia. Later, in ancient Greece and during the Roman Empire, lenders based in temples made loans and added two important innovations: they accepted deposits and changed money. However, Modern Banking evolved in 14th century in the prosperous cities of Renaissance Italy but in many ways was a continuation of ideas and concepts of credit and lending that had their roots in the ancient world.

Functioning Of Banks:

With the advancement of technology and with the emergence of internet in the banking sector many changes can be observed in the functioning of banks. However, the main function of the bank still remains the same which is to generate revenue in a variety of different ways including interest, transaction fees and financial advice. Traditionally, the most significant method for this is via charging interest over the capital it lends out to customers. The bank profits from the difference between the level of interest it pays for deposits and other sources of funds, and the level of interest it charges in its lending activities.

This difference is referred as Spread between the cost of funds and the loan interest rate. Historically, profitability from lending activities has been cyclical and dependent on the needs and strengths of loan customers and the stage of the economic cycle. Fees and financial advice constitute a more stable revenue stream and banks have therefore placed more emphasis on these revenue lines to smooth their financial performance.

Major Challenges in banking sector:

For Every action there's an equal and opposite reaction.

I feel these line by Sir Issac Newton fits in banking sector too. Being the Primary Financial Sector of any country the banks are having issues which includes:

- Challenge #1 – The Rising Interest Rate Environment

- Challenge #2 – Navigating the Regulatory and Compliance Landscape

- Challenge #3 – Delivering Mobile Banking for Primary Status

- Challenge #4 – Driving Greater Marketing ROI With Data-Driven Insights

- Challenge #5 – Creating Personal Connections in an Increasingly Digital World

Besides above mentioned challenges that the banking sector is facing in the retail sectors in the conventional banking system which is completely different if we compare it to The Islamic Finance System.

Problems Of Islamic Banking system?

Islamic banks are essentially governed by their Shari’a boards – the religious scholars that deem a product Shari’a-compliant. But the challenge is that there is no central authority promulgating Shari’a law, and the understanding of what is hence permissible and what is not varies among Islamic scholars and jurisdictions.\n\nThe rapid growth of Islamic banking over the years has resulted in the introduction of complex banking products and structures, which now require Shari’a harmonisation at a global level which is lacking at present.

Due to this harmonisation and approved regulatory standards the banks around the world follow, make them easy to expand and conduct operations in different countries, whereas there are no approved standards for Islamic banks. It is due to this reason Islamic banking differs from conventional bankin and it is difficult for Islamic banks to completely follow these global conventional standards.

Due to the prohibition of interest, Islamic banks mobilise and utilise funds using Shari’a-compliant instruments or contracts that are not used by conventional banks and hence their capital structure primarily consists of Tier 1 capital only, while only a handful of Islamic banks have Tier 2 capital. Another differentiation between the two banking models is the bank’s ownership of the asset: in Islamic banking contracts like Murabaha, Islamic banks have to own the asset for a period of time, a practice that is not required in conventional banking practices.

The Solution

Thanks To Menapay!

For solving the issue facing by the islamic financial system.

What is Menapay?

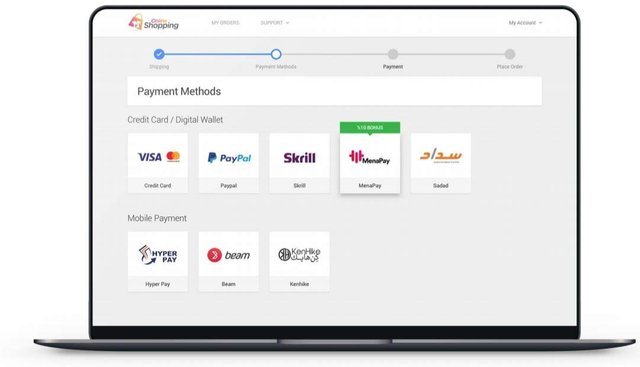

MenaPay is the first fully blockchain based payment platform focuses on the Middle East and North Africa region (MENA). It is a platform that allows transactions on a blockchain with very low transaction fees, not affected by fluctuation of cryptocurrencies, faster and more reliable than any traditional payment gateway.

Menapay has been designed to work with Islamic finance requirements. The Platform does not use or give interest and shares the revenue of the platform with the MenaPay Token Holders according to Islamic finance approach. it is due to this structure, MenaPay is expected to help the digital transformation of the region.

MenaPay has its own stable MenaCash which is designed to be used in any online and offline transactions of daily use. MenaCash has a stable value equivalent to 1 USD which is warranted by the same amount of USD kept in multiple banks as fiat currency equal to the amount of MenaCash in circulation.

Vision of the project:

The aim of the project is to become the most commonly used cryptocurrency in the MENA region among 18 countries and 441 million people, with the vision of becoming the largest non-bank payment solution by using blockchain technology while generating significant returns for the investors. MenaPay Token Holders will be the nucleus of the community to disrupt traditional banking system in MENA and will create the most advanced financial system which will cover the entire region with Islamic compliant, transparent and decentralized structure.

Difference Between MenaPay Token and MenaCash?

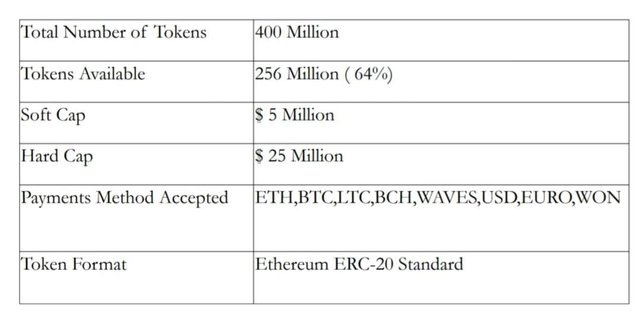

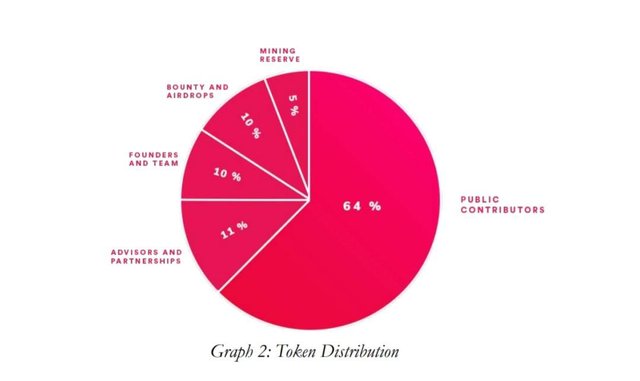

In the blockchain ecosystem, a token represents a tradable asset or a utility on a blockchain. MenaPay Token is a utility token which will be issued with a limited number of 400 million where 64% (256 million) of the total tokens will be owned by the public. MenaPay token is used to distribute the revenue share of the platform between holders. Token holders will take a share of the company revenue accordingly with the amount of MenaPay tokens in their wallet. Token holders will earn their share as MenaPay tokens. MenaPay will be able to be purchased from exchanges after the ICO.

MenaCash; is a stable cryptocurrency of the MenaPay platform which will be used for daily transactions between 3 dynamics in the system; users, merchants and foundation. Transactions between users P2P (peer to peer), transactions between users and merchants P2M (peer to merchant) and transactions between approved merchants and MenaPay Foundation for conversion of their MenaCash to fiat currency purposes M2F (merchant to foundation) will be possible by using MenaCash.

MenaCash will be generated on the MenaChain private blockchain to assure secure and fast transactions between the users.

Need for MenaPay:

As the era of digital technology is expanding its growth, the high penetration rate of smartphones and internet connectivity all over the world, more than 84% of the adult population in the MENA region is unbanked, while three in four bank customers are ready to switch banks for a better digital experience. With the population of MENA getting younger, better educated and more demanding, a need for improve financial services occurred. MenaPay has been designed to solve themproblems that traditional payment/ banking system has, besides creating a chance to get rid of the obligation of carrying cash and recognition of fake cash. Besides this its is also a way to have an easy, fast and secure payment opportunity for those who does not prefer banks and bank products— debit or credit cards—due to religious beliefs. With this aim to digitize payment in all areas of daily usage; life will be easier for MenaPay holders while merchants who do not use credit and debit cards will be available for shopping.\n\n# Products of MenaPay :\n\nThe Menapay system comprises of;

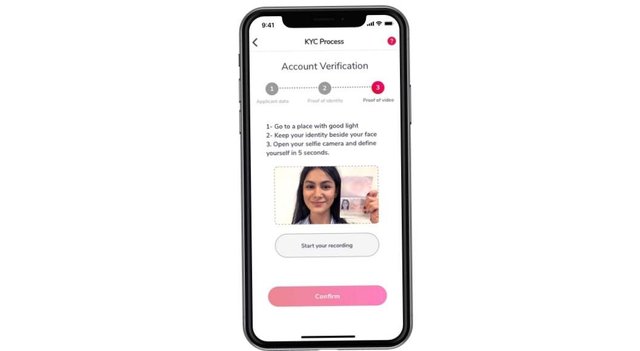

KYC (Know Your Customer)

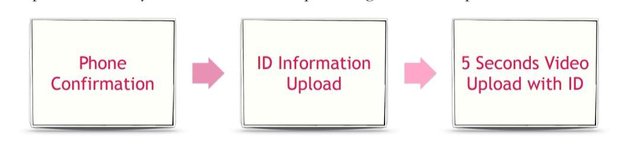

This will be done to ensure that no illegal activities are performed on the Platform and to provide the customers a secure network. All users, merchants and resellers who reach an accumulated process volume of 100 MenaCash are subject to KYC process which will be done in 4 steps:

• The user completes the mandatory and optional profile information and confirms his/her email address.

• Any officially recognized identity document (National ID, Drivers Licence or Passport) is uploaded to the platform.

• A 5-second video record which clearly shows the document and the face of the person is uploaded to the platform.

After verification of the documents KYC process is held to include firm information including legal documents, firm’s financial history and business licences for institutional users.

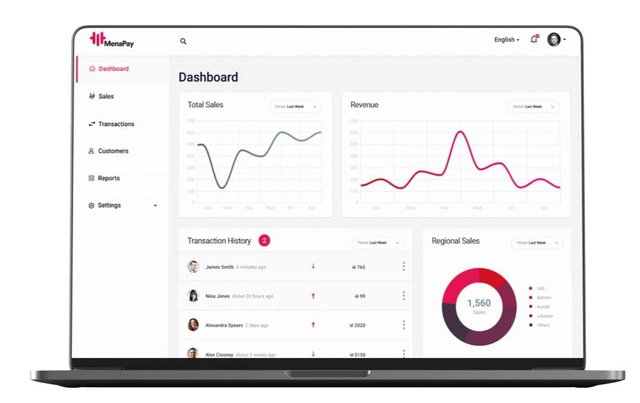

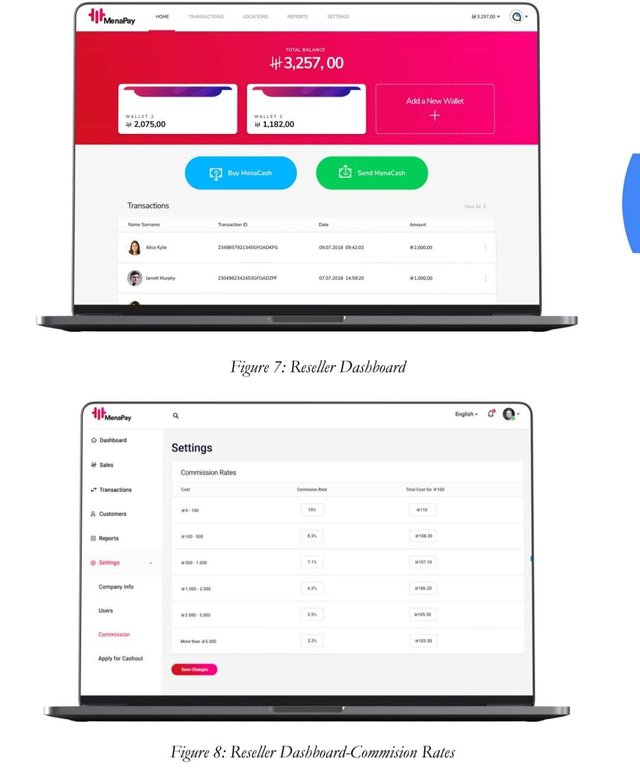

Dashboard

Merchants using MenaPay Dashboard can:

• Track the number of transactions, transaction volume and Transaction ID, customer ID, Revenue, Payment Status, Date, etc. processed over the MenaPay Platform and get detailed reports within seconds.

• Reach their retrospective transaction details using the Transaction IDs which are produced uniquely for every transaction.

• Reach the payment history, payment frequency and shopping tendencies data of their customers on a user base.

• Join the “Approved Merchant” network and cash out their MenaCash.\n\n• Dynamically change their commission percentages on their sales and build a commission system according to price ranges.

• Refund their customers individually or as a group.

• Offer a secure shopping experience with its KYC (Know Your Customer) property.

Reseller Application

The Application is designed specially for the MenaCash sales. Entreprises who are entitled to be Resellers and who are listed on the Reseller App can easily conduct MenaCash sales .

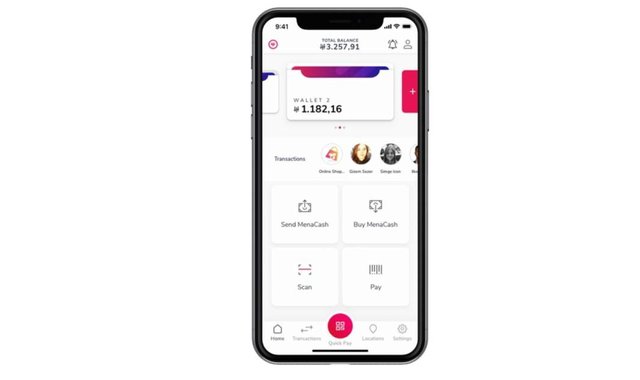

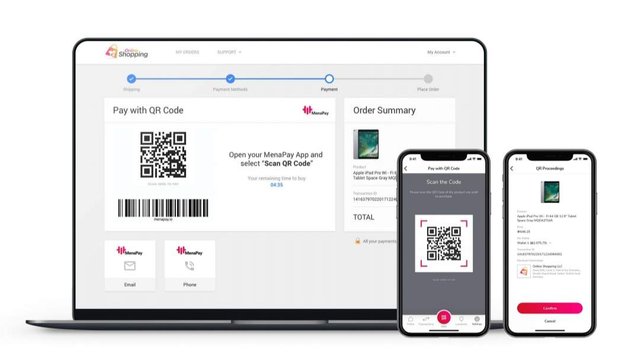

Mobile & Desktop Payment App (Wallet)

By downloading the wallet application the user can perform the following features:\n\n• Buy MenaCash from Resellers or the MenaPay Foundation.

• Send /receive MenaCash to/from another user at any time.

• See the Reseller network on a map to choose where to buy MenaCash.

• Shop using the QR code, phone number, barcode or the wallet ID the merchant has provided within seconds.

• See the retrospective transactions report.

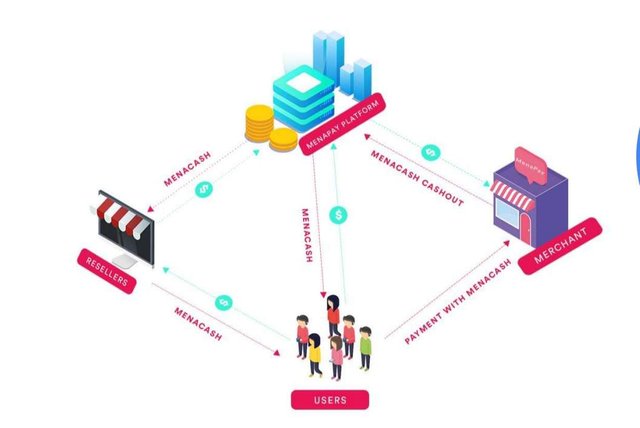

MenaPay EcoSystem

The menapay ecosystem comprises of the following:

The merchants

Or the building blocks of the menapay ecosystem along with the individual users. Merchants who register with the platform and start MenaCash acceptances can use advance features of MenaPay. MenaPay also presents an easy-to-register platform where merchants can execute their sales operations and keep track of there sales data with the help of an easy-to-integrate Software Development Kit (SDK).

Merchant Approval

For every merchant the submission of following documents are required in order to be part of the menapay ecosystem

• Certificate of incorporation

• Certificate of registered address

• Certificate of shareholders

• Passport copy of the signing director(s)

• Utility bill of the signing director

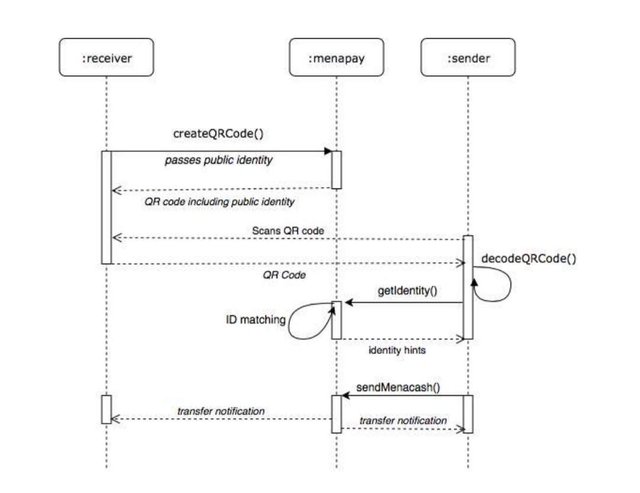

Merchant and wallet ID matching:

The merchants and users will be able to add more than one wallet into their applications. Every wallet has a unique ID which will be matched with users. Wallets held by the merchants are matched with their identities and will be shown to the customer during the transaction of payments. which provides assurance to the customer regarding transfer of the payment.

Individual Users:

Individuals have to perform following protocols in order to mentain menacash in there wallets.

User Approval This can be done when The user sign up to the MenaPay Platform with their phone number after downloading the app and the signup process by entering the verification code which they recieve on there phone.

\n\n(Note:when the transaction limit of menacash reaches 100 KYC process is initiated to prevent fraud and fake accounts.)

Reseller Network

These include group of enterprises other than menapay foundation who have authority to sell menacash. these include Internet cafes, exchange desks, jewelers, markets, etc. For becoming the part of reseller network an institution or an individual must fill the application form along with the necessary documents. These documents iclude;

• A copy of the Certificate of Incorporation\n\n• Registered Name

• Registered Address

• Shareholder List

• Passport or Driving Licence of the Director.

Once approved they can perform the following work in the menapay ecosystem:

• Buy MenaCash from the foundation through credit cards or wire transfers.\n\n• Decide the commission rate over their sales and make rate updates on a customer base.

• Share the sales document with the customer which is issued at the time of the sale.

• Track sales records and produce reports over their sales with the Dashboard provided for them

** P2P (Peer to Peer) Transaction**

It is the transaction performed between two individuals. this can be done providing phone number, email, nickname, public key or QR code of the reciever to the sender through menapay gateway.

P2M (Peer To Merchant) Transaction

It is the transaction made by the customer to the merchant. the processof the payment is same as that of p2p transaction.

M2F (Merchant To Foundation) Transaction

Merchants can keep the menacash and use it for there own purchses or they can initiate cash out request. once Cash out requests opened by approved merchants are closed by the foundation on returning the fund, keeping 1 MenaCash = 1 USD equality. The minimum limit for cash out is 1,000 MenaCash. MenaPay Foundation claims 5% commission over the amount cashed out.

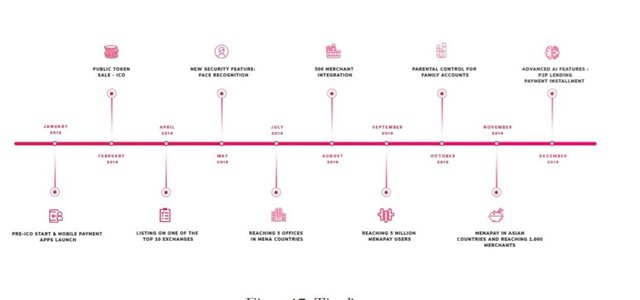

ICO Details And Timeline

Distribution of Tokens

Roadmap

Team

Posted using Partiko Android

In A Nutshell

Every Coin has two faces. Banking sector also have two faces the positive one and the negative one and from the past few years the negative side of banking dominated more as compare to positive. The evolution of MenaPay and Blockchain will bring some hope in uplifting the negative image of banking in positive way slowly and gradually.

More Information At:

website: https://www.menapay.io

whitepaper https://menapay.docsend.com/view/pwjr8rt

Twitter: https://twitter.com/menapayio

Telegram: https://t.me/menapay

Linkedin: https://www.linkedin.com/company/menapay

You got voted by @curationkiwi thanks to inder! This bot is managed by Kiwibot and run by Rishi556, you can check both of them out there. To receive maximum rewards, you must be a member of KiwiBot. To receive free upvotes for yourself (even if you are not a member) you can join the KiwiBot Discord linked here and use the command !upvote (post name) in #curationkiwi.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by inder from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Congratulations @inderjot! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Congratulations @inderjot!

Your post was mentioned in the Steemit Hit Parade for newcomers in the following category:

I also upvoted your post to increase its reward

If you like my work to promote newcomers and give them more visibility on Steemit, consider to vote for my witness!

Congratulations @inderjot! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOP