Lattice Exchange DeFi Platform: Addressing Interoperability, Scalability and High Transaction Fee Challenges On The Ethereum Network

Introduction

It is no longer news that Blockchain and cryptocurrency are currently taking over the financial world as we know it, revolutionizing how people and institutions interact and transact with each other. It has greatly helped in decentralizing finances, making it vastly easier to transact and move funds from one point or person to another.

Also, it has provided an alternate means of investment to the masses who have hitherto, found it hard to cross the high entry barriers placed on profitable traditional investments. This way, cryptocurrency has served the purpose of redistributing wealth, at least to a very large extent and with it's advent, more people have access to asset owning and trading. One of the fastest growing blockchains on the cryptosphere is ethereum network. Ethereum blockchain has a high versatility that affords a wide range of tools for DApp builders and users. It's exponential growth has been instrumental in the rate at which blockchain technology is being adopted by mainstream institutions.

Now, every good thing doesn't come easy and for a monumental revolution such as Blockchain and cryptocurrency with emphasis on ethereum blockchain, there's been loads and loads of challenges especially given the fact that this technology can be considered to be in its infancy and already experiencing great upsurge in usage and interest. The ethereum network,despite it's considerable growth and user base, is saddled with such challenges as interoperability, scalability, slowed transaction times and most annoying of all, high transaction fees in recent times. These challenges poses a real issue to mass adoption of cryptocurrency and there has been numerous attempts made by emerging blockchain protocols to solve them. While some have made some headway, the problems have persisted and even getting worse.

One of the most recent developments in the cryptosphere geared towards solving some of these challenges is the emergence of Decentralized Finance, DeFi.

What Is Decentralized Finance?

As the name implies, Decentralized Finance are financial services that use smart contracts, which are automated enforceable agreements that don’t need intermediaries like a bank or lawyer but rather, online blockchain technology instead to facilitate transactions between users. For existing DeFi Platforms, on-chain pools provide the liquidity needed to carry out trades using an automated market making (AMM) strategy. Unfortunately, the AMM used by existing DeFi platforms are simply written algorithms and while it fosters easy user experience, the probability of low liquidity is quite high and therefore creates room for mad price fluctuations in the platform.

Secondly, since these platforms have a single source of liquidity pool, slippage and transaction fees tend to be on the high side hence making transactions expensive and defeating the main aim of blockchain technology.

Lastly, the simplicity of the AMM makes it highly unsuitable to accommodating all cryptocurrency pairs. What this simply means is that there is a limit to the amount of currency pairs that is obtainable on any existing DeFi platform.

So, how exactly does Lattice Exchange propose to mitigate or solve these issues?

The Lattice Exchange Solution

Lattice Exchange is uniquely built using ethereum network and Constellation's Hypergraph Transfer Protocol (HGTP). Its objective is to provide an advanced and modernized trading solutions for crypto assets by providing an advanced AMM algorithms for liquidity providers and users alike.

How Does Lattice Exchange Work?

Lattice Exchange will be a development of existing DeFi arrangements by giving more affirmation in cryptocurrency exchanging and settlements and the capacity to join different particular and resource explicit mechanized Market Making Algorithms. This arrangement will additionally propel the blockchain business with improved monetary instruments that are practical and have the speed, security, and versatility that contemporary assets resource brokers are acquainted with.

Constellation Hypergraph Transport Protocol (HGTP) is the main secure interchanges convention that associates genuine applications through consistent tokenized information. Constellation empowers an environment of utilizations to be based on the Hypergraph Network while utilizing the HGTP to safely catch, associate and transport that information for an advancement of uses with information affirmation and consistence. Hypergraph is a tough decentralized organization that is based on a Directed Acyclic Graph (DAG) and use dynamic parceling and a notoriety based agreement instrument to be endlessly versatile, while giving quick throughput to deal with high computational requirements for instant data handling.

Features of Lattice Exchange include a flexible liquidity pool, advanced market making, advanced matching algorithms and the Lattice governance tool in form of the tokenized LTX. LTX is the exchange's native token that gives certain governance rights to holders on parameters like transaction fees, deflation and inflation.

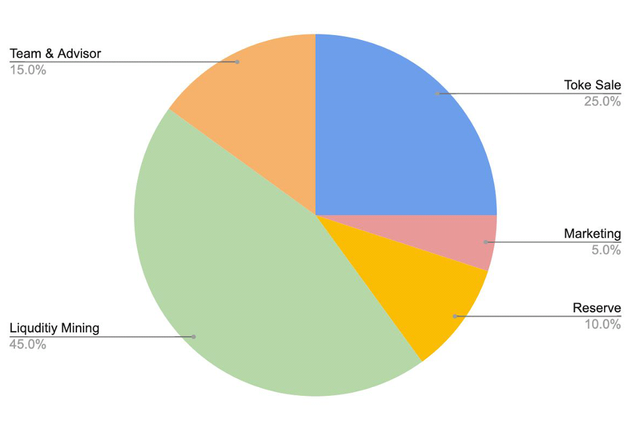

Here's a look at how the LTX token is distributed:

Some Lattice Exchange partnerships include the following companies and organizations:

To read more on this unique project, here are some links you can visit

Website

https://lattice.exchange/

Whitepaper

https://lattice.exchange/Lattice-Exchange-Official-Whitepaper.pdf

Writer's BountyOx Username

Ebykamsi

A sponsored article written for a bounty reward.