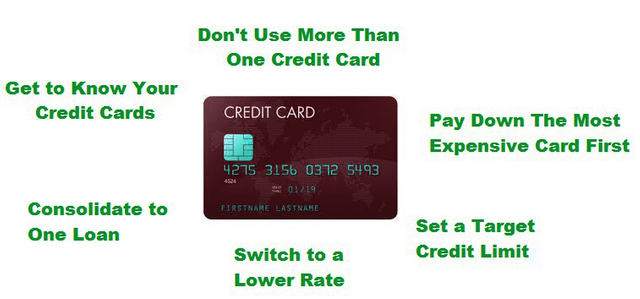

6 Tips to Pay Off Your Credit Cards Faster

Credit cards are a major cause of financial stress. Accumulating a credit card debt is as easy as spending today and worrying about it later. When we want to buy something, we forget about the high interest rates, and our existing balances, instead we see an available limit. It's no surprise so many of us lose control and find ourselves struggling to manage our credit cards.

Getting your credit cards under control will improve your finances, reduce your stress, and put you on a path to a better future (financially). Here are our 6 strategies to help you get rid of your credit card debt.

Get To Know Your Credit Cards

It's important to know how your credit card works, specially if you have more than one. You can get all the information you need either from your monthly statement or online banking. For every card that you should keep track of:

- Your Credit Limit - Banks often offer us automatic credit increases, and we can lose track of our current limits. It's important to know your limits.

- How Much You Owe - Are you close to your limit, or do you have some funds still available? Be careful not to go over your limit, or your purchase might get declined, or even worse, you'll get some nasty over limit fees

- Your Interest Rate - In Australia, we've seen credit cards with interest rates ranging all the way from 9% to over 30%. Make sure that you know how much interest each card is charging you

- Your Minimum Payment - If you pay less than this amount each month, you will incur nasty fees.

- Your Payment Due Date - If you don't make your minimum payment before this day, you will incur more nasty fees.

- Your Ongoing Fees - Does your credit card charge an annual or monthly servicing fee? How much is this?

Don't Use More Than One Credit Card

If you have more than one credit card, then decide which one you would like to use actively. Take the other cards out of your wallet, hide them somewhere safe, and focus on paying them off. We suggest using the card with the lowest interest rate and no ongoing fees.

This will help you keep track of your spending better, you can send a monthly spending allowance to your active card, and send debt repayment amounts to your inactive ones. Having the more expensive cards out of your wallet will reduce the temptation to use them impulsively, but they will still be there in case of an emergency.

Pay Down The Most Expensive Card First

After you've sent your monthly allowance to your active card, make the minimum payment on all your other cards, then pay the remainder into the card with the highest interest rate. The higher the interest rate, the more you save when you repay the debt.

Once you have paid down the most expensive card, move onto the next most expensive until you have paid them all down. Repaying your cards in this way will ensure that you minimize the total interest your are charged while you repay your credit cards.

Set A Target Credit Limit

One of the biggest problems with credit cards, is that they are so easy to use. Spending up to and even beyond our credit limit is as simple as waving a piece of plastic. The best way to manage this temptation, is to set a realistic and manageable target limit on your credit cards. Your goal might be to have a credit card limit of $5,000 once the debt is under control.

If you currently have a total limit across all your cards of $15,000, and you want to get it down to $5,000, then we want you to gradually reduce your credit limit. If you pay your debt down by $1,000, then reduce your limit by $1,000. Keep doing this until it hits zero, and you close the card. Don't wait until the card is fully paid off, otherwise there will be the temptation to spend that money.

If you need to have access to funds in your credit cards for emergency purposes, then set an emergency buffer. For example, if you need a buffer of $4,000, then every time you have $5,000 available, reduce your limit by $1,000. Banks will allow you to reduce your limit in this way, and some of them will even let you do this through online banking.

It should go without saying, but if you want to get out of credit card debt, then never accept a limit increase offer. If you are near your limit, but have not gone over and have not had late payments, then banks will sometimes send you an automatic limit increase offer. Accepting these offers probably got you deeper into debt in the first place, so we don't want you to accept any more in the future.

Switch Your Credit Card To A Cheaper Option

Does your bank issued credit card have benefits such as frequent flyer miles? If so then it probably has an annual fee and an interest rate somewhere near 20%. If you have one of these cards, we want you to go into your bank and ask them to switch your card to their lowest rate simple credit card. In Australia, most banks have a no frills credit card with no ongoing fees and an interest rate closer to 10%. The flyer miles are costing you more than they are worth.

You can also move your debt to a lower rate by using a balance transfer. However be careful as there are potential risks with balance transfers. The first problem with balance transfers, is that they do not force you to cancel the card you are transferring out of. You can effectively increase your total credit limit, and with it comes the temptation to spend and get yourself even further into debt. If you take up a balance transfer, then close and destroy your old card.

Most balance transfer deals come with an introductory offer of reduced or no interest. While this is absolutely beneficial, pay attention to what will happen after this introductory period. It is possible, that you will move your debt from 10% to 20% (with a few months of no interest in the middle). Make sure that the end deal is good, before accepting the attractive introductory rate.

Consolidate Your Credit Cards

If you have multiple credit cards, then speak to your bank about consolidating them into a personal loan. Personal loans generally have a lower interest rate than credit cards, and are designed to be paid off within a known time frame (but can also be repaid faster). This also gives you the convenience of only having to manage one repayment, rather than juggling between multiple cards.

If you do consolidate your credit cards into a personal loan (or a home loan). Then we want you to close all your credit cards except one. The one with the lowest interest rate can stay, but you need to reduce the limit to your target end limit. As with balance transfers, consolidation has the danger that the credit cards will not be automatically closed. You have to do this yourself, so once your credit card is paid off, please destroy it, then close the account.

This is a very thorough post reviewing a complicated area of personal finance. Good job.

Thanks for the positive feedback, I'll try and keep the content coming :)