The Bull Run is NOT Over

The crypto market is recovering from a huge blow. First Musk and then the Chinese government decisions brought Crypto down at almost half its valuation from the recent yearly high.

Right after Elon Musk first announced Tesla removing Bitcoin ($BTC) as a payments option and a few days later the Chinese government deciding to proceed with regional banning of cryptocurrency mining.

There are signs of stabilization though. Moreover looking at the charts it seems that soon we will witness a breakout formation to the upside.

This is decision time.

Usually, I try to avoid price discussions and short-term predictions But, I will make this one exception, because I find the risk to be at low levels, and almost all indicators I'm watching seem to point to a reversal of the negative trend that has recently formed.

.png)

Crypto to Continue the Bullish Trend

MACD points to a break-out (3D chart)

It is about time prices for a reversal.

Technical indicators for the weekly are mostly negative or neutral, but moving averages of all kinds are not to be considered stand-alone advice to buy. If it was as such then every trader would be profiting.

An important factor from this chart is the possible breakout of the MACD, which is at a good point to give a buy signal for traders. I've found the 3-day chart to be more important than the daily and possibly from the weekly too. I avoid the 1D chart completely.

The consolidation period seems to be ending and a change of the bearish short-term is possible with a massive upside movement.

Sentiment: Extreme Fear

Sentiment has weakened a lot and turned bearish since May. However, more than often Cryptocurrencies begin to rise again when the sentiment reaches "extreme fear".

Extreme fear is always a great entry point. We are buying when everyone is scared and this risk is justified. To win in this game you have to go against the grain.

You don't just follow the trend and invest as a sheep. The crypto market has not reached its full potential and should visit new ATHs sooner or later.

Crypto MarketCap

This is the famous trololo chart adapted for the total crypto market.

The "trololo" chart predicted with great accuracy the date BTC reached the $10k level, three years before.

The original chart was posted on bitcointalk in 2014.

I've marked in this chart the fact that in the previous bull runs prices surpassed the upper band, which is also an indicator that probably this bull run has not ended yet.

This time is not different either, since what I see happening in the last weeks is the beginning of another rapid upwards movement for the crypto market.

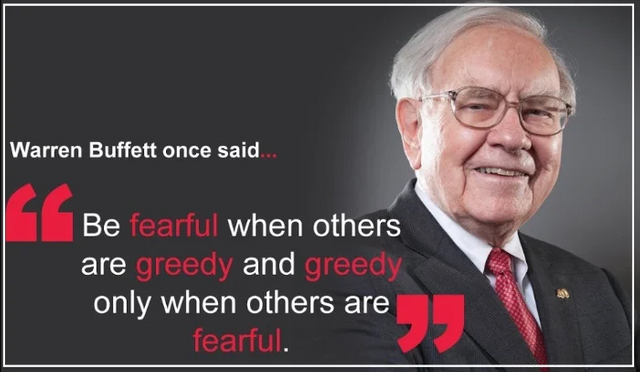

Google Trends

I've written about this chart in noise.cash a couple of days ago. These are the search results from Google Trends for the word "Bitcoin" in the USA.

This indicator just reached half of what it did in 2017.

This chart proves that the parabolic wave for the crypto market simply didn't happen yet.

There seems to be this pattern of what is an awareness phase, a stand-by mode right before the final wave.

If this pattern plays out and at about August prices begin to rally, we could see a repeat of the final >part of the 2017 bull run (September '17 - January '18).

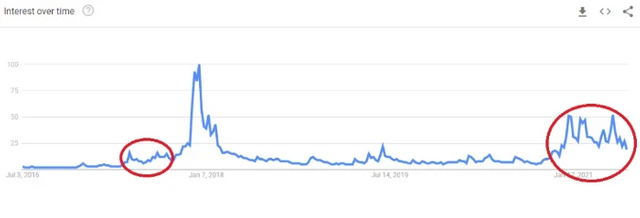

Miners Exodus from China

Miners are on their way to exit China and moving to other locations.

Decentralization of mining was partially a big issue, however, there is also the issue of decentralization of development for BTC, ETH, and other major cryptocurrencies, something that is not a problem for Bitcoin Cash though.

The fact that China cracked down on mining has created a negative short-term outlook for Bitcoin (BTC) and a correction for the whole industry.

While hashrate dropped a lot, this was already priced in since the Chinese crackdown announcement. The price for BTC dropped a little more, down to $26,000, which could be a bottom unless massive negative news emerges.

The previous mining "epoch" for BTC ended yesterday with a difficulty change of -27.94%. This allows miners around the world to turn on machines of the previous generation like S9 and mine with profit. I'm expecting the hash rate to stabilize probably during this epoch (~14 days) and begin rising again.

Moreover, the mining situation in China can be considered to have a potentially positive effect in the long run, since this wasn't just about BTC but most cryptocurrencies were mined at high percentage levels in this country.

A relocation of ASICs is already underway and China is losing its leverage in this market completely. It will become more secluded with the advance of its CBDC, and having less competition will probably harm the financial freedom of the Chinese citizens.

The BTC hashrate decline was priced-in since May. There was a secondary drop below 30k and down to $26,000 but nothing changed. History is usually repeating itself but it is never the same since variables and dynamics always change.

Starting with Bitcoin (BTC) and then moving into cryptocurrencies like Ethereum (ETH), and Bitcoin Cash (BCH) their networks are secure and a 50% attack is something that is not possible to happen.

The whole hashrate discussion is about the short term. Hash rate translates to more production, more machines running, and more security for the networks.

A drop of 50-60% doesn't represent less security. BTC, BCH, ETH, LTC had advanced security levels and it wouldn't be possible to undermine them with a 50% decline in hash rate.

Usually hash rate increases as the price increases. It follows demand, and as difficulty drops, older machines are put into action since they become profitable again.

Banks Are Getting In Crypto

Banks seem to still be interesting in offering cryptocurrency investment options through their trading desks and applications.

A new deal with NCR and NYDIG has opened up a way for banks across the U.S. to offer Bitcoin >buying options to their customers.

-Bitcoinist Source

JPMorgan and Goldman Sachs are still undecided and give conflicting reports, however, this just proves there is huge interest and this time Crypto is being treated with more respect than previously.

The El Salvador Enigma

The El Salvador news is met with distrust by part of the Crypto community, since BTC was proven it can't be used as a currency and the Lightning Network will probably never fully develop either, to meet mass adoption. However, even this helped increase support, it was possibly a plan-b move but it wasn't played out as it should to completely change the negative trend.

This was certainly a strategy to create support after the latest China ban news, but wasn't calculated to details and created more confusion, since a third party (Strike) and Tether were involved. Moreover, there was no mention of other cryptocurrencies that actually work for everyday transactions with low fees and high-speed networks, as BitcoinCash, Dash, ZCash, Monero, or even XRP.

The laser eyes gimmick is also discouraging serious investors. It creates an immature image for the BTC community and is criticized heavily by other cryptocurrency communities.

.png)

Bulls Are Coming Back (Conclusion)

This correction in already on its second month and I see that the revival of the bullish trend is quite probable.

Starting within the next few weeks, we might relive the final part of the parabolic trend (as in 2013 and 2017) that is the special mark that characterizes Crypto's price action.

There will be contradicting indicators any time we look at this market. We can't have 100/100 indicators giving us a "buy" signal. We look at the odds and then proceed accordingly.

I see another wave coming and it will be equally massive as the wave initiated in September 2017. I'm also expecting to see a short-term bounce for BTC above $40,000 and possibly reach $50,000 during this month (July).

There are still 4-6 months left for the market to achieve its maximum potential.

The best is yet to come.

.png)

Originally posted on Read Cash

- Lead & First Image from: WSJ

- BTC Chart Image (2nd one) from: BitcoinWisdom

- Fear & Greed Image (3rd one) from: Alternative.me

- Warren Buffett Image (4th) from: Investing.com

- CryptoMarket Image (5th) from: AasaSoft

- Google Trends Image (6th) from: Google Trends

- HashRate Image (7th) from: Blockchain.com

- Bulls Gif from: Tenor

Writing on the following networks:

Noise Cash

Read Cash

Steemit

Hive

Medium

Vocal

Minds

Vocal.Media

Den.Social(inactive)

Publish0x(inactive)

I'm also active on the following social media: