GOLD STOCK: Sibanye Gold CRASH? OR BUYING OPPORTUNITY? YOU DECIDE

Hello everyone.

I would like to take a moment to talk about a stock I have a small position in and also one that is one that gets overlooked "quite often"....

I am talking about Sibanye Gold.

First of all, I like this company because it is one of the "FEW" and I mean FEW gold stocks that pays dividends. Check how many other gold companies out there do this... Extemely low... I like passive income wherever it may be. Means less works for me of course. That being said, allow me to explain WTF happened on Friday.

N!&%@ This shit just got real...

HOWEVER!!! ALL IS WELL... iF LIKE ME, YOU ARE A LONG TERM GOLD\SILVER BULL.

Once you dig into wth actually happened, you will find the the company acquired a new mine and financed the dept and payment with shares, which usually dillutes shares. The mine is in USA, so SBGL is now not just international, but diversified. It acquired a platinum and Palladium mine. Luckily for me, I had a small put option as a hedge in case the stock dipped so the hit was not really felt that hard and that money will go right back into buying at lower prices. :)

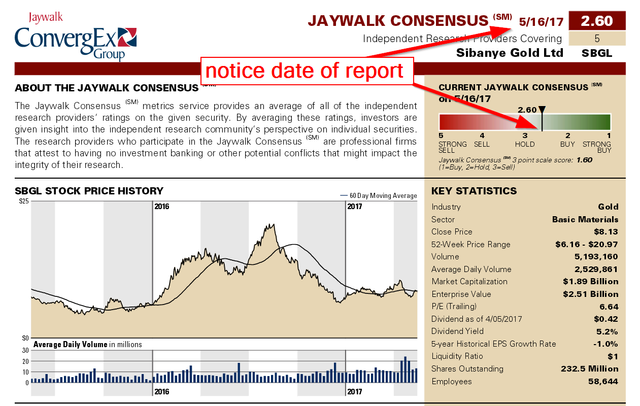

I am an investor who spends time looking for gold and silver plays... but you don't have to take my CLEARLY BIASED opinion... see below.....

.

.

.

Before the smash of the price, the stock still had this from another report...

One thing many people don't know or FAIL to GRASP are GAPS!!! GAPS have a 90% of filling... meaning this stock will fill that gap down moment as well..

see youtube video below for GAPS explained... IT helps in putting option calls as well if you want to place those kind of bets.

Before the aquisition, SBGL was among the TOP 10 GLOBAL GOLD PRODCERS...... but now with this new addition, it will be among the top 5 metal producers GLOBALLY. Invesors like me will be offered a chance to buy shares at $2 a piece as a way of saying sorry bro... to which I am ok with since I see the long term potential of SBGL.

Article below helps explain this as well.

https://bnlfinance.com/2017/05/19/32-crash-sibanye-gold-nysesbgl-stock-creates-perfect-buying-opportunity-stillwater-acquisition-complete/

NOTICE: if you are a current holder like me, we will be given stock options at 60% discount to make up the difference.

I will save you the time in regards to the article below. It means shareholders are give rights to buy shares at a reduced price only for a very limited window time frame. :) This will compensate and make up for the dilution. Also, more shares means more dividends when the time comes around.. :)

https://seekingalpha.com/article/4074712-sibanye-rights-offering-explained

Nice and potentially useful piece. thanks

Thank you. I thought it was... :)

Very interesting. Thanks for the time you put into this analysis. By sheer luck I bought some mining shares in January 2016 and they had a huge run up before slamming back down. But, I am still looking to invest in another mining stock. This may be it. Thanks again.

You are welcome. As I said before, I am biased because I am a holder of this stock and this is not going to scare me out of it. :)