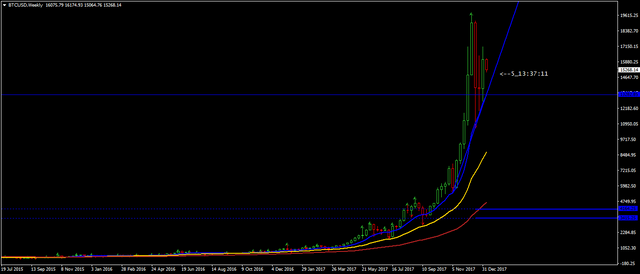

Bitcoin overnight price action shows yet another flag pattern (Fractal #4) and this is not at all surprising. I believe an a,b,c expanded flat is likely but primary pathway remains same.

This guy's counts don't follow the rules of Elliott wave. Within a 3rd impulse wave you should be able to count 5 sub-waves--with the 3rd being the largest. These sub-waves are fractals. Flags are not Elliott fractals.

The sub-waves of this apparent 3rd wave do not appear to be forming 5 waves within the higher degree 3rd. The count already looks invalid.

BTC is following a reversion to the mean down to 8,500-9,000 to hit the 150EMA.

I noticed that too. I am wondering if haejin can keep up his reputation when market is not good like last June and July. BTW, does the 3rd wave rule work in crypto? I think it doesn't necessarily be the largest sometimes.

It "cannot be the shortest" is the rule as far as I know - in other words, it it IS the shortest, your count is invalid, try again - that's my take so far. But by saying, "you should be able to count...as the largest" the guy contradicts himself.

EW is based on the Fibonacci Ratios and the Fibonacci Ratios are the Ratios of nature. Do you think that with the invention of Bitcoin the National Security Agency of the USA managed to overcome the Law of Nature?

Agreed. You don't get flags, caps or any other kind of nonsense in wave 3. A reversion to the mean down to 8,500-9,000 would be the bare minimum. A weekly close below $13282 implies continuation all the way down to the lower $4K. And that is what I put as the BTC target for 2018.

13600, no lower - Haejin may still be at 15k, but I said down to 12k maybe yesterday - still, 13.6k is my best guess. I had been hoping for 8k like Mike Novogratz and all you guys, and dreaming of $4 to finally get my Lambo - but let's face it boys, talking it down on steemit and CNBC for Roger & Ver just may not work out.

Most people hodle along anyways and all the Indian peasants and their Rupees are now excluded from Bitfinex and Binance, so they cannot be made to panic.

For the current leg down you are right, - we are looking to bounce from $13550-13600. But impulse waves don't start by bouncing around. Especially third waves.

Yes, there's a very strong band of support between $11700 and $13860 provided by the Gann's square of 9 daily cycles congestion zone and we will need quite some time and effort to level it off and to eventually break it through. But once it's done there's nothing serious to hold this market all the way down to 233 days WMA currently @ $7700

Last but not least we are not talking tomorrow or next week, we are talking 6-8 months from now.

As expected, we began our move down to the 8,500-9000 area with authority. I suspect we're nearing the end of subwave 1 down, correct up in 2 and then violent 3rd wave down.

All the comments below are excellent. Very astute Elliot technicians!

Excellent point, wave 3 just can't be the shortest, and 5 is sometimes longest. Very good clarification.

Interestingly wave 3 can be short in an ending diagonal, but that is EXTREMELY bearish! However, typically 3rd wave is longest with 5 defined fractal sub-waves. The typical projection for wave 3 is 100% to 161.8% of wave 1. It's an impulse so it explodes, it doesn't dilly dally around like above.

AstonMartin: Yes the 3rd wave rule applies to crypto. Elliott applies to all tradable assets. Crypto, gold, stocks, bonds, forex, real estate, etc. It applies to everything that is traded by human beings because i models human emotion. Emotion drives 90% of price action IMO so as long as humans are trading it, their emotion is driving its price.

Here's the my primary count. Feel free to rip it apart. :)

You have proved to be incredibly accurate with your TA. Maybe you should spend more time studying TA and less time running haegin who actually knows how to do it down.

Well... it's all we have, to compare the past and the typical developments, as in 'history repeats itself as human nature never changes' - and TA, EWs and Gann's and all that jazz try to stylize this and put it into formulas. Rituals.

That's all that can be said.

The entire cortex is a possible-futures-prediction instrument that works better the larger it is, to a degree... but with larger size, a secondary effect sets in.

We can predict the future better than a dog can - but we also refuse to react and stay inert when it gets difficult, where the dog just flees... this because the multiple possible developments make a decision harder.

The pilot whale, with almost twice our cortex volume, playfully dreams and creates its own reality, floating in the ocean... we're in that same box ourselves and I can easily prove it.

Think gods and afterlife, and how the average human will prefer paradise to fickle Elliot Waves any day ;)

Hot money goes elsewhere, and each cryptocurrency will have its day on the sun, until they are all there or there about. This continues until, in the real world, markets crash, at which point all the institutional money will be needed elsewhere, and all the trivial amounts in crypto get recycled back into "real" money, because there will be a huge need for "real" money.

Haejin, please don't use dtube, it doesn't work here, never! I am not into fractals but i think there is a nice fractal on Steem/USD forming, 2nd explosion expected in a few weeks

BTC

Great Post!. Interesting Story. I want more of this. Keep it up

BTC seems quite trapped at the moment

Bitcoin has eased off in the past few hours. Hopefully it will explode up as suggested, to the region of $20k!!

BTC has been stuck in limbo..

This guy's counts don't follow the rules of Elliott wave. Within a 3rd impulse wave you should be able to count 5 sub-waves--with the 3rd being the largest. These sub-waves are fractals. Flags are not Elliott fractals.

The sub-waves of this apparent 3rd wave do not appear to be forming 5 waves within the higher degree 3rd. The count already looks invalid.

BTC is following a reversion to the mean down to 8,500-9,000 to hit the 150EMA.

Larger chart here: https://www.tradingview.com/x/WMJAkpWR/

GLTA

The Capitalist Bear, enough said already, I stoped reading reddit comments, now i guess I have to stop reading comments here also, to not get fooled.

I noticed that too. I am wondering if haejin can keep up his reputation when market is not good like last June and July. BTW, does the 3rd wave rule work in crypto? I think it doesn't necessarily be the largest sometimes.

The rule portion of the 3rd wave is that it must not be the shortest. Not always the longest.

True

The 3rd wave rule being the longest in cryptos is only sometimes true because like commodities, the fifth wave is often the longest.

It "cannot be the shortest" is the rule as far as I know - in other words, it it IS the shortest, your count is invalid, try again - that's my take so far. But by saying, "you should be able to count...as the largest" the guy contradicts himself.

EW is based on the Fibonacci Ratios and the Fibonacci Ratios are the Ratios of nature. Do you think that with the invention of Bitcoin the National Security Agency of the USA managed to overcome the Law of Nature?

Agreed. You don't get flags, caps or any other kind of nonsense in wave 3. A reversion to the mean down to 8,500-9,000 would be the bare minimum. A weekly close below $13282 implies continuation all the way down to the lower $4K. And that is what I put as the BTC target for 2018.

https://www.mql5.com/en/charts/8134910/btcusd-w1-simplefx-ltd

13600, no lower - Haejin may still be at 15k, but I said down to 12k maybe yesterday - still, 13.6k is my best guess. I had been hoping for 8k like Mike Novogratz and all you guys, and dreaming of $4 to finally get my Lambo - but let's face it boys, talking it down on steemit and CNBC for Roger & Ver just may not work out.

Most people hodle along anyways and all the Indian peasants and their Rupees are now excluded from Bitfinex and Binance, so they cannot be made to panic.

For the current leg down you are right, - we are looking to bounce from $13550-13600. But impulse waves don't start by bouncing around. Especially third waves.

Yes, there's a very strong band of support between $11700 and $13860 provided by the Gann's square of 9 daily cycles congestion zone and we will need quite some time and effort to level it off and to eventually break it through. But once it's done there's nothing serious to hold this market all the way down to 233 days WMA currently @ $7700

Last but not least we are not talking tomorrow or next week, we are talking 6-8 months from now.

Here's a thorough EWA by TradingDevil, not sure we can find someone better than this guy.

I don't remember all details of this analysis but he's on the same page as Haejin.

As expected, we began our move down to the 8,500-9000 area with authority. I suspect we're nearing the end of subwave 1 down, correct up in 2 and then violent 3rd wave down.

All the comments below are excellent. Very astute Elliot technicians!

Excellent point, wave 3 just can't be the shortest, and 5 is sometimes longest. Very good clarification.

Interestingly wave 3 can be short in an ending diagonal, but that is EXTREMELY bearish! However, typically 3rd wave is longest with 5 defined fractal sub-waves. The typical projection for wave 3 is 100% to 161.8% of wave 1. It's an impulse so it explodes, it doesn't dilly dally around like above.

AstonMartin: Yes the 3rd wave rule applies to crypto. Elliott applies to all tradable assets. Crypto, gold, stocks, bonds, forex, real estate, etc. It applies to everything that is traded by human beings because i models human emotion. Emotion drives 90% of price action IMO so as long as humans are trading it, their emotion is driving its price.

Here's the my primary count. Feel free to rip it apart. :)

You have proved to be incredibly accurate with your TA. Maybe you should spend more time studying TA and less time running haegin who actually knows how to do it down.

explain

Let's face it, it's all bollox, if it were that easy to use formulas from past charts to make profits, everyone would do it.

Cg

Well... it's all we have, to compare the past and the typical developments, as in 'history repeats itself as human nature never changes' - and TA, EWs and Gann's and all that jazz try to stylize this and put it into formulas. Rituals.

That's all that can be said.

The entire cortex is a possible-futures-prediction instrument that works better the larger it is, to a degree... but with larger size, a secondary effect sets in.

We can predict the future better than a dog can - but we also refuse to react and stay inert when it gets difficult, where the dog just flees... this because the multiple possible developments make a decision harder.

The pilot whale, with almost twice our cortex volume, playfully dreams and creates its own reality, floating in the ocean... we're in that same box ourselves and I can easily prove it.

Think gods and afterlife, and how the average human will prefer paradise to fickle Elliot Waves any day ;)

Your analysis are the best, good video :D

Hot money goes elsewhere, and each cryptocurrency will have its day on the sun, until they are all there or there about. This continues until, in the real world, markets crash, at which point all the institutional money will be needed elsewhere, and all the trivial amounts in crypto get recycled back into "real" money, because there will be a huge need for "real" money.

Could you please do an update on Litecoin?

It all boils down to the lightning network.

What is gonna happen?

Haejin, please don't use dtube, it doesn't work here, never! I am not into fractals but i think there is a nice fractal on Steem/USD forming, 2nd explosion expected in a few weeks