The end of CC market as we know it.

The development shows how some big financial players are moving to co-opt the volatile cryptocurrency and lure more mainstream investors into the market, even before regulators have agreed on just what bitcoin is.

CME Group Inc.’s contracts will debut Dec. 18. Cboe Global Markets Inc. didn’t announce a start date. Both got the green light Friday after going through a process called self-certification -- a pledge to the U.S. Commodity Futures Trading Commission that the products don’t run afoul of the law.

https://www.bloomberg.com/news/videos/2017-12-01/bitcoin-futures-get-regulators-ok-on-cme-cboe-video

I think what will happen is that not only Institutional Investors will be speculating on Bitcoin futures but also the Plunge Protection Team which suppresses gold prices for years.

Such an irony, exactly what Bitcoin stood up against.

is it means CC market will become boring and slow?

in my opinion cc market will explode. and will be controlled by mostly whales

So you think the US government found a way to kind of null in void bitcoin?

I think not only bitcoin but the entire CC market as all ALTs mostly move in sync with BTC. I think initially the price of BTC will jump but then the PPT will suppress it as they do it with gold and silver because they don't want bitcoin to undermine the public confidence in paper US dollar.

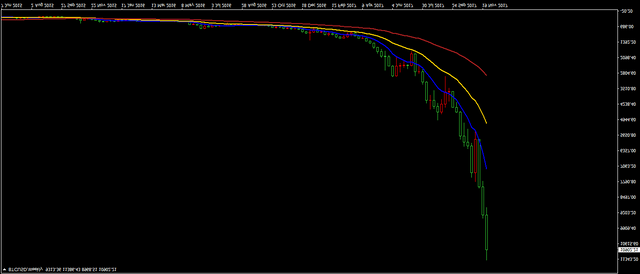

Rotate the chart and you will see how the dollar is falling against BTC

https://ibb.co/k1aNsw

Event Horizon...Once it has been breached there is no escape. We'll see how much power the inflationary system really has over the next couple of years. I'll just buckle up and enjoy the ride for now!

I think this is inline with your thinking

https://www.google.com/amp/s/www.forbes.com/sites/panosmourdoukoutas/2017/08/23/big-governments-will-crush-bitcoin-but-wont-kill-it/amp/

I think the the crypto bubble will be allowed to grow until it creates a true hysteria among the general public. That way any crash can be pinned on market sentiment fluctuations. Once a true crash has happened, I wouldn't be surprised if @srezz's hypothesis plays out. It's much easier to suppress something once it has been knocked down than to knock down something that doesn't want to be suppressed.

The truth is we are in uncharted territory. The central banks have shown they will do almost anything to retain control, but the public is increasingly turning away from them. If they move too quickly, they risk further eroding whatever faith is left in their system. If they wait too long, they risk taking heavy handed measures.

@srezz makes a good point about the bankers improved toolkit, but I honestly think they kind of want to see how strong this phenomenon is - we've just entered the public awareness phase. I've seen numerous public statements by head bankers saying things along the lines of "cryptos are an insignificant share of the market and do not currently pose a threat". These statements may be misdirection, but I tend to think this is their way of saying "have fun while it lasts because we will stop it as soon as it becomes significant".

Agreed

Well shit...

Wish i had more to offer on this, but i don't.

I guess i'll be doing much Googling for the next week to form some hypothesis.

It all makes sense, I imagine there will be a bit of a fight and some tug o war. The glimer of hope i can offer is as follows.

Sir Richard Branson, is highly involved in block chain. I hope it if for the better and greater good and not to manipulate. He holds a block chain summit every year.

I think this summit is to advance the use and acceptance of bitcoin and block chain, but now i wonder.

Well, keep me in the loop of whats happening with this and the PPT. i'll continue to do homework o the matter.

Something for your homework:

...the NSA, in conjunction with MIT, produced a white paper in 1996, spelling out how an anonymous cryptographic currency could circumvent the current cash system. This was a full 12 years ahead of Sat-on-sushi’s white paper explaining bitcoin. Never mind the fact, as The Daily Economist pointed out, Satoshi’s white paper just happened to hit the wire during the 2008-2009 economic meltdown, actually being released on Halloween 2008. Personally, I gave up on coincidences decades ago....

Srezz, so are u out? Or still going to ride the wave a little longer.

Still have a small position in ETC as it offers one of the best rates of return.

Thanks @srezz !

I guess that the CME wont include ALT contracts though right?

Isn’t there a chance of another crypto driving force to emerge from this, in case of course BTC starts displaying Gold like behaviour?

To drive the entire CC space wherever they want to BTC futures contract with options on the top is more than sufficient.

Just a layman question , why not PPT were able to cope with 2008 financial crisis?

Because they arranged it in the first place. It's their creation. They did not have tools at the time to continue pumping up bubbles. So, they popped them by pooling the rug of liquidity underneath AIG, - the major counterparty risk insurer. Today with High Frequency Trading and no mark to market valuations they are much better equipped to rob you by stealth taxation of inflating to oblivioun paper currencies. Bitcoin price is the clear evidence of it.

I'm having a hard time with this one. Bitcoins growth against the U.S. dollar is due to eroding confidence in the dollar. Bitcoins growth has been fueled by those that see the value in a decentralized currency. Betting on Bitcoin derivatives may have some effect on BTC price, but control it? Is it really possible to sway enough of the BTC hodlers back to centralization? I think that would be underestimating the power of those of us that believe Bitcoin is the currency of the future which no government can stop.

Bitcoin growth has nothing to do with those naive people who believe in decentralization of power by having decentrilized currency. Bitcoin growth has been fueled by the Wall Street money and their algorithms. The only limitation up to this point was liquidity of the existing CC exchanges preventing players to go naked short with a good leverage. Now it is no more.

I think we'll just have to agree to disagree on this one. I could cite more reasons, but the back and forth isn't worth the energy. I still like your charts!!

You can cite whatever you want and I'm not here to argue with you and/or to convince you of anything.

But my charts are what they are precisely because they are based on the knowledge of how the world of finance is turning around.

Ofc there is always a risk for govrenment to naked short with this in order to start a panic breakdown in real BTC price, but imo it's not gonna be easy as bitcoin is already global and is as such much easier to buy than their instrument for majority of folks on the planet.

@srezz 4 months ago you wrote

and it actually did play out very much like you predicted. BTC did jump to almost 20k on 16th of December and now entier cc market is down ~70% since then.

What can I say? Personally, I tend to ignore conspiracy theories as much as possible and the one about the 'cartel' suppressing the price of silver, gold and now BTC, certainly does sound like one for me. But if that wasn't a coincidence, you were spot on. Kudos to you for that.