Crypto market data adjustment

CoinMarketCap has expressed that it avoided the three Korean trades from their midpoints "because of the outrageous dissimilarity in costs from whatever remains of the world and restricted arbitrage opportunity."

CoinMarketCap, maybe the go-to hotspot for cryptographic money showcase information, has started a hubbub after it moved to bar South Korean trades from its value normal counts.

The unannounced move to expel information from Bithumb, Coinone and Korbit from its normal counts started perplexity given that its first page recommends an expansive decrease in the cryptographic money showcase, including what had all the earmarks of being a close to 30% fall in the cost of XRP.

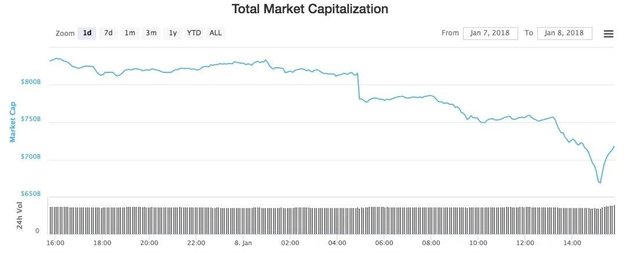

The general market top of the market – one measure by which brokers survey the biological system – dropped pointedly once the change became effective, which seems to have occurred just before 5 a.m. UTC.

That move can be quite found in the 24-hour value diagram for bitcoin money, given that the three Korean trades are among the main 10 by profession volume for the cryptographic money.

The correct explanation behind pulling the information isn't clear as of now, however as of press time Bithumb is disconnected due to what the trade says is a server check. Also, costs on those trades have reliably exchanged far over whatever remains of the market, for example, the more than $5,000 spread contrasted with business sectors like Bitfinex and GDAX.

Further, reporters like Ripple boss cryptographer David Schwartz, who tweeted out about the move, said the recently reflected cost is "more precise and significant."

That conclusion hasn't saved CoinMarketCap from the crypto-group's rage, in any case.

Online networking posts crosswise over Reddit and Twitter have chastised the website, crying foul about the absence of any formal declaration that they say prompted a genuine value decay as brokers responded to what they saw as a tumbling market.

And keeping in mind that CoinMarketCap avoided Korean trades from its information, other information destinations indicated comparable decreases in resource costs.

OnChain FX's information coordinated CoinMarketCap's costs, yet CoinCap, while as yet demonstrating decreases in valuing for the greater part of the best 50 crypto-resources, showed higher costs for bitcoin, ether, XRP and bitcoin money than CoinMarketCap.

Essentially, information site LiveCoinWatch demonstrated bitcoin tumbling to $14,787, somewhere close to CoinMarketCap' $14,754 and CoinCap's $15,596 at time of composing.

The adjustments in the diverse locales' information go past just costs. Though LiveCoinWatch still shows XRP as the second-biggest resource by advertise top, the other information locales now indicate ethereum retaking its previous spot.

Source :www.coindesk.com

Good

Nice

Nice bro

Good

Good poste

Good poste

Nice

good post

Good post

Nice