Trading cryptocurrencies: a honest introduction

This is the first part of a series of articles about trading cryptocurrencies (not sure how many yet). I will cover the very basics and more: from which trading platform to use, to more advanced content such as technical indicators and chart reading. I hope it can help you in any way.

A realistic blow

I'm sure you all have come across a lot of articles on the internet that tell you how you can become rich in no time by trading cryptocurrencies. I'm not going to lie, it's true, you can. However, you shouldn't ignore the fact that it's really difficult. The "How I became a millionaire with trading" articles and other risqué, click-bait derivatives are just unreliable—if not scammy— sources of information to form an objective opinion on trading. Making money consistently by trading cryptos not only takes a solid education on the cryptocurrencies themselves, but also on technical analysis, money management, and emotional control. This implies some things that many beginners take for granted, namely that you'll have to withstand losses, lots of losses; no matter how good of a trader you are, you are going to lose money. The main difference between a good trader and a bad one is that the former loses less money. The social media, the film industry, and the dubious marketing ethic of some brokers have flooded the world of trading with unrealistic expectations that often lead to your losing all of your savings. So If you really want to make money by trading cryptos, come down here to Earth and keep your feet on the ground.

Understanding human emotion

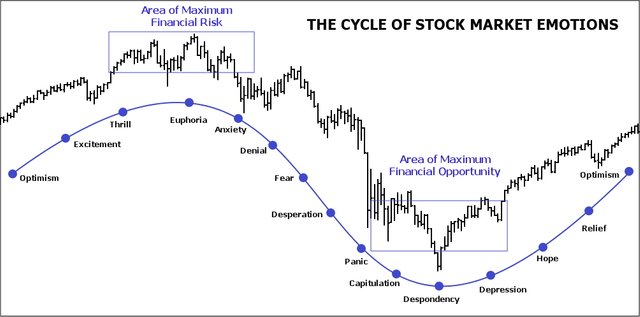

After all, war, love, and the stock market aren't that different. They are all fueled by human emotion. The case of the crypto space is a really good example. It is driven, more than by anything else, by hype and panic. A huge breakout in the prices means that hype has taken over most traders' minds, and a deep drop means that everyone is panicking and wants their money back asap. Generally speaking, the average crypto investor/trader is a dreamer. He's heard of Bitcoin's unending bullish trend and wants to join the party no matter what. This means that in most cases he's going to take part in the market without any prior consideration or technical knowledge. It is for this reason that the news, whether they be true or false, play a crucial role in the evolution of the crypto space. Hence we have the so-called "buy the rumour, sell the news". There is no need for something to actually happen to affect the market prices, all you need to do is get some relevant authority to assure that it will happen and let the magic be. With this in mind, you might realise that with a minimum of education and rational thinking, you'll have an edge on most of traders out there.

There is hope in the end

I didn't want to discourage you with my introduction, but I think everyone needs a good dose of raw reality on this topic. However, there is still hope in the end. You can dream, and you can dream big, if don't let your emotions lead you astray. You need to assign a deliberate plan to your dreams, and they will no longer be dreams, but goals. Trading requires a balance between vivid passion and ruthless rationality. The former impels you to do the thing, and the latter makes sure it is the right thing. You have to combine the two to be successful in anything, not just trading. This said, with some trading tools under your belt you can make money consistently, all you have to do is start small and do something everyday—no matter how insignificant—to get closer to your goal.

In sum...

Thanks for reading!

Hyperion