Why ICOs Continue to Boom Despite the Crypto Bear Market

ICOs (Initial Coin Offerings) are continuing to attract mammoth amounts of funding in 2018, despite the crypto bear market we have been experiencing this year.

So far in 2018, an astonishing $7.6bn has been invested in ICOs, even though the cryptocurrency market overall has fallen close to 50% since the start of the year.

That compares to a total of $3.8bn raised through ICOs in the whole of 2017 and less than $100m raised in 2016.

It’s worth breaking down the numbers to have a look at what’s been going on and why ICOs continue to be so popular, despite tough market conditions for cryptocurrencies in general.

2018 — A Year of ICO Madness

We may not even be half way through the year yet but there has already been huge investment into ICOs in 2018 — more than eclipsing the total amount invested in 2017 already.

Although $1.7bn of the $7.6bn raised so far in 2018 has been down to just one ICO (Telegram), that still leaves $5.9bn that has come in for other ICOs.

Here are the top 10 ICOs by amounts raised so far in 2018 (according to Coinschedule.com):

- Telegram ICO (Pre-sale 1 & 2) $1,700,000,000

- Dragon $320,000,000

- Huobi token $300,000,000

- Bankera $150,949,194

- Envion $100,000,000

- Elastos $94,100,000

- Flashmoni $72,000,000

- Neuromation $71,669,400

- Zeepin $62,600,000

- Olympus Labs $60,300,000

As you can see, quite a large portion of the total amount raised is taken up by a few of the top ICOs, but interestingly there have been 315 ICOs completed so far in 2018, raising an average of $24m each, which is no mean sum.

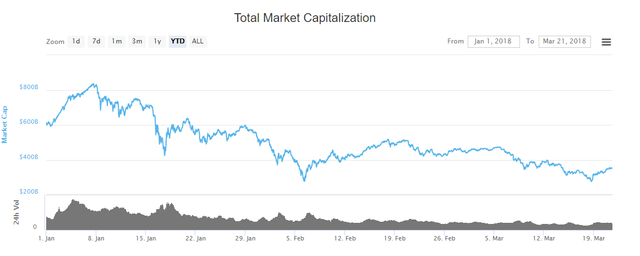

This eye-watering amount of investment has come at a time when the crypto market generally has been in bear territory, dropping over 50% since the highs seen in January.

Total Market Cap of Cryptocurrencies in 2018, courtesy of coinmarketcap.com

So what gives? How come money continues to pour into new blockchain-based projects despite the general malaise gripping the markets?

Hype Is Still Powerful

One of the main reasons ICOs continue to do so well may be because of the extraordinary amount of hype that surrounds them.

Even though Bitcoin and other top cryptocurrencies have dropped from the stratospheric heights of late-2017, they continue to attract a lot of media attention, with every pronouncement and wild price prediction made by Bitcoin zealots like John McAfee attracting headlines.

And so there is still great hope that new and upcoming projects can become the next “disruptor” in their industry, whether it be travel, entertainment, finance, energy or any particular niche you care to name. The idea is that by using blockchain technology, these newcomers can streamline processes and undercut rivals, whilst at the same time providing a superior service.

Many of these ideas sound great in theory and a number of them have gone on to be runaway successes like Ethereum, Ripple, Litecoin and others, but a portion of them don’t even have a working product when they come to launch their ICO. They rely purely on hype, which can be magnified greatly across social media and various internet channels.

A Bigger Audience

Another potential reason for the success of ICOs is that the potential pool of investors is much bigger than for traditional venture capital.

Whilst there are some restrictions in the US — and China and South Korea have banned ICOs outright — in the rest of the world ICOs are largely unregulated, meaning anyone can participate.

That is in contrast to traditional venture capital for startups, where only accredited investors are allowed to invest —or in other words only the very wealthy.

How long ICOs remain unregulated is open to question, but for the time being the fact that the “average Joe” can invest in any ICO he or she likes with just a few dollars clearly opens token sales up to a much larger pool of investors.

That is reflected in the fact that ICOs have absolutely crushed venture capital over the past year, raising 3.5 times as much capital according to Crunchbase.

Monster Returns

Of course a big piece of the picture is likely to be people chasing monster returns from token sales.

If we have a look at some of the best performing projects in terms of their current token price compared to the price during the ICO, some of the returns are truly staggering:-

- IOTA: 3,967x

- Ethereum: 2,170x

- NEO: 2,000x

- Stratis: 841x

- Spectrocoin: 479x

- Ark: 286x

To put those returns into context, if you had invested just $100 into IOTA during its ICO, that would now be worth $396,700. Not a bad little nest egg.

And those are just some of the top performing ICOs. There have been plenty of coins which have gone 10x or 20x without even getting much of a mention when people talk about success stories in crypto.

As tales of monster returns have spread, people have joined the ICO craze hoping to match some of those gains and achieve potentially life-changing profits.

Beware of the Flipside

However, whilst these stunning returns can be very alluring, beware the harsh facts behind ICOs.

According to an article on Bitcoin.com, 46% of the ICOs in 2017 have already failed, with a further 13% no longer active and effectively defunct, meaning a worrying 59% of the ICOs in 2017 have crashed and burned.

So investing in ICOs is a very risky business and whilst you could hit IOTA- and Ethereum-like returns, you could also end up investing in a dud.

And when an ICO goes wrong — either by running off with your money or the product never materialising— there is basically nothing you can do to get your funds back. There is no authority you can complain to or body you can ask for compensation. Your money is gone.

What to Look For in ICOs

Interestingly, when taking a look at the numbers above regarding failed ICOs, most of them are projects that raised small sums during their token sales. The 531 projects judged to have failed or be failing raised a total of $233 million between them from their ICOs, equating to an average of less than half a million dollars raised each.

So certainly one thing to look for is how much money a project raised during its ICO (or is raising if the ICO is still in progress). By no means will a large fundraise guarantee success, but according to the figures above it appears that a small fundraise is more likely to point towards failure.

Other things to look out for include:

- The quality of the team

- The idea behind the project and whether there is a genuine use-case for it

- How far developed the actual product is

- The quality of the website, White Paper and communications from the company; and

- What kind of support the ICO is getting from the crypto community.

- These are all factors I look at when reviewing ICOs and should be the minimum basis of any research before considering an investment.

Conclusion — ICOs are the Ultimate Boom or Bust

ICOs have continued to raise enormous sums of money in 2018, despite the general slowdown in the crypto markets.

This is probably due to people being attracted to the excellent returns of earlier token sales, some of which have generated 1000x returns. The unregulated nature of the market has also allowed everyday investors to participate in token sales, thus vastly increasing the potential investor pool compared to venture capital.

In addition there has continued to be a lot of hype around ICOs, which has probably contributed to their phenomenal fundraising success.

There is no sign of the ICO boom slowing down — quite the opposite, it looks like it is actually gathering steam. The success of token sales seems to be driving more innovation in the sector and drawing more entrepreneurs towards cryptocurrency, thus improving the quality of offerings and attracting more investment, creating a kind of virtuous cycle.

However, whilst investing in ICOs can seem like an attractive option, it is vital to do your due diligence before parting with your hard-earned cash. Despite some amazing success stories, 59% of ICOs held in 2017 have already failed.

So when looking into ICOs, remember that they can be the ultimate boom or bust investment and there is no substitute for doing thorough research before taking the plunge into the supposed next big token.

Do you suggest some newborn ICOs to look for?