Starta ICO: Full Review. Bridging the Gap Between the United States Venture Capitalists and Russian Tech Startups.

Recently a friend of mine asked me to take a close look at the Starta ICO being held on the Waves platform from July 4th through July 30th, 2017. Being a big fan of the Waves platform I took a dive and found some interesting information about this new ICO. I will be honest I was not prepared to go as deep as I did, but there is a lot of relevant information to find here. Rather than just keeping what I found in my close circle of friends, I decided to post about it. Hopefully those of you interested in the Starta ICO will find this helpful and informative.

For those of you short on time, read the "Final Verdict" at the bottom for a summary and come back to read the details of how I have arrived at my conclusion later when you have the time. I promise it is an interesting new innovation and you will enjoy your journey of learning more about it.

What is Starta Coin/ICO?

The Starta ICO is a different kind of animal than most cryptocurrency investors and traders are used to. Instead of inventing a new product, offering a new service, or even reinventing existing products and services with blockchain advantages, this is a new form of Venture Capitalism is being offered to the people at large in the cryptocurrency sphere of influence. Instead of requiring a significant level of capital (money), they are offering for people to join the VC group with micro-payment sized contributions as low as $1. This is a very promising idea, so I jumped down the rabbit hole to find out more.

First let’s get one thing straight: Starta ICO is really CrossCoin Ventures and not a new Venture Capital (VC) firm. By buying Starta ICO tokens you are first and foremost investing in CrossCoin who is investing in the VC group Starta Capital. Starta Capital VC is focused on buying into new eastern European tech start-up's valued under $2 million and training them to market themselves better to the American VC investment space. Essentially, they want to help these companies gain recognition in the lucrative Silicon Valley VC space and they are not shy about their ambitions to exit out of these companies at "x5, x10, and x50" valuations. They are trying to help these new startups sell out to the big and rich American businesses and other VC's and make a massive profit while doing it.

CrossCoin was started in 2014 and is registered in Wilmington, DE, USA. It is run by a group of four investors: Gary Kremen, Steve Bennet, Adam Marsh, and Ryan Orr.

As the apparent leader, Gary Kremen, is famous for selling Sex.com for a Guinness World record price of $14 million and starting Match.com which is one of the world’s most popular dating sites today. Kremen was removed as the CEO of Match.com in mid-2015 by the very same VC groups that helped him start the company. The reasons they publicly offered seemed to go along the lines that Kremen was going against the wishes of the VC's and made poor management decisions. I am not sure what to think of this because the same VC's that ousted Kremen eventually sold Match.com for just $7 million two years later (also against Kremen's wishes). Kremen has gone on to become a successful angel investor and has started and participated in dozens of new startups and even a couple of VC firms in Silicon Valley. Also, Kremen was recently elected to the Santa Clara Valley Water District board of directors.

The reason I am focusing so much on the leadership of CrossCoin Ventures is because, like I said earlier, CrossCoin is not selling a new product or creating any kind of technology on its own. They are simply offering regular investors to partake in their latest venture. Since there is no technology to research, it only leaves the leadership of this VC coin to examine.

Now Let's Talk About What They are Offering

For the purposes of ICO a Singapore-based legal entity Cross Coin will acquire part of Starta Accelerator 16/17 LLC portfolio and will be selling tokens. Cross Coin have built a token buy-back mechanism that creates transparent profit distribution model at portfolio liquidity events and at the same time creates an opportunity for investors to potentially increase the value of their tokens through token market price volatility.

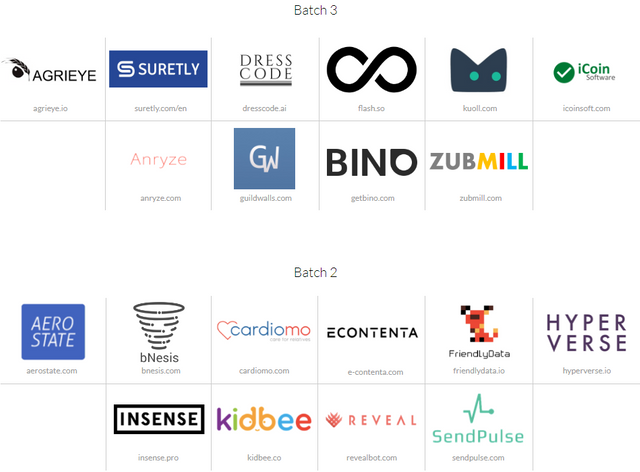

This is their official statement in their white paper. This basically means that CrossCoin will start a Singapore based legal entity that will purchase 33% of the Starta Accelerator 2016/2017 portfolio batches 2 and 3 of companies. According to the white paper there are 21 companies in total, but the Starta Accelerator website is showing only 20 with the last one (Cindicator) appearing to be part of batch 1. This is a bit confusing and no matter where I look, I can't seem to find a clarification on this.

CrossCoin is planning to buy 33% of the $3 million-dollar investment the Starta Accelerator owns. On average, the Starta Accelerator owns about a 7% stake in each of the 21 companies. As the white paper says, the Starta ICO will use $1.5 million to purchase that $990,000 worth of stock and use the rest of the funds for future investments of similar nature. So, presumably new batches of the Starta Accelerator VC group.

Companies Being Represented

Finally, let’s talk about the companies being represented. I have not spent enough time researching each one of the 21 companies listed, but I looked at some of the most promising ones. There are innovative ideas like AI assisted mass email marketing, cloud based thumb drives, and even a "VR out-of-the-box" software. Each one of these companies has a working product and some of them seem to have some potential. If you are interested in the specifics, please visit the Starta Accelerator main site and click on each of them to visit their respective sites.

Final Verdict

The Starta ICO is an innovative new way to raise capital that offers investors to join the cause with very small investments. This seems to me to be the natural evolution and merger of the Venture Capital world with the Crowdfunding world. A potentially very lucrative proposition for all involved.

The reason I have not and will not invest in the Starta ICO has to do with several factors:

- Why is the Starta Accelerator selling 33% of their portfolio at only a 150% profit when their public goal is 500%-5000%?

- Current USA - Russia state of diplomacy.

- Current USA and EU sanctions on Russia and vice versa.

- Potential profits may not come for 2-8 years (according to their white paper).

- They are only focused on the US market and are ignoring the rest of the world (why not Europe and Asia too?).

The biggest issue for me is that these companies may not see any interest in their technologies until the diplomatic situation normalizes between the US and Russia. Despite the fact that Starta Coin SVP will be based out of Singapore, the companies they will own a stake in are mostly located in Russia. Any American VC group interested in buying them out or even just investing in them will have to consider how they can do so legally. It would be a massive risk to take for a VC or a tech giant to buy out or acquire one of these startups with the existing political tensions between the nations and I doubt many will even consider it. Who is to say that they will be purchased at all or that the purchase price will be at a profit? How many years will the Starta Accelerator hold these companies with no profits in sight before dumping to get what they can out of them?

Each of the companies’ valuation listed on the websites and in the white paper are based on the capital they have raised so far up to 2017 in Russia and we all know that those valuations may not hold up by the time they reach the American investors. In my opinion after the ICO is officially over and this token hits the Waves DEX, it will plummet in price like so many ICO's do when they hit the open market. If the political climate changes in the next couple of years I may revisit this potential investment, but at this time I do not believe this is a worthwhile pursuit.

Thank you for reading and please upvote, follow, and resteem if your enjoyed my article. Or at least upvote 😉

Starta ICO Images: Starta Twitter and Starta ICO page

Gary Kremen Image: Business Insider: How Match.com's founder revolutionized the dating world — and walked away with just $50,000

Crypt0.Critic Images: CleverCat

This blog is written for informational and entertainment purposes only. As the author, I can honestly say that I am in no way associated with any blockchain based company. My opinions are my own and are offered freely. My opinions and suggestions and are NOT INVESTMENT ADVICE! Please do your own research before considering any high risk investments.

Excellent Blog. I was looking for more info on this ICO.

Thanks

Did you mention an ICO??

https://steemit.com/meme/@valderrama/these-ico-s-are-a-problem

🤓😂

That is exactly why I do these in depth reviews. Too many FOMO investors not doing their own homework... I don't want to see people rush in blindly! And the Spin Artists promoting these ICO's are very good at making stuff sound better than it is

An informed investor is a wise investor!

And, excellent post by the way. I had to upvote.

great great post man! upvoted

Good job!

This ICO has a lot of potential, but beware, ICO's are very risky and don't invest what your not willing to lose

Interesting article ! Just upvoted you.

If you are interested in Stocks, Cryptos, P2P Lending, Real Estate and investing in Science check out my blog.

Best regards,

Alex

https://steemit.com/@artur1972

Starta ICO analysis from a legal point of view