Challenges funding my crypto hobby

Man. First world, early adopter problems...

I wanted to put some fiat currency into my crypto-education adventure. I have been studying the crypto space since early December 2017 when I started on my crypto journey. In retrospect, it was a bad time to begin as the markets were poised to continue to skyrocket or, more inevitably, return to earth in the coming weeks. But what did I know when just starting out on my crypto-adventure? Like so many others, I had been on the sidelines for a long time (months-years) never really feeling compelled to jump into the market and start educating myself. I knew it was really cool, but...

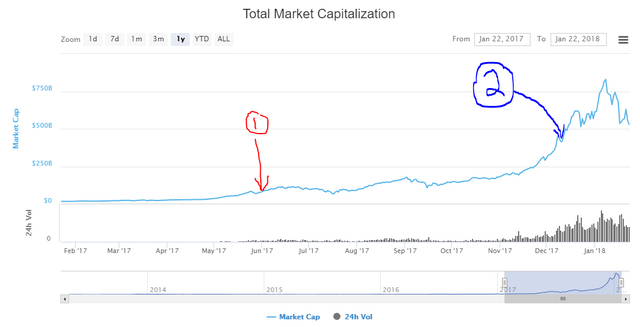

I remember at the end of last May 2017 (See #1 on chart) I attended a presentation on cryptocurrency by some very knowledgeable people within that space. There were approximately 250 people in the audience. The speaker opened the presentation by placing a piece of paper on the table at the front and said that it was a paper "wallet" containing some bitcoin. The first person who could come to the front during the break or whenever, could claim it by scanning the QR code. It sounded interesting to me, but I didn't have a wallet app, and it sounded like more work than it was worth. What exactly is a wallet? What app was I supposed to use for it? I had known about Bitcoin for a few years and always thought about getting in, but never did. Anyway, the person beside me popped open his phone and claimed the contents of the paper wallet.

- Time of Refused Cryptocurrency Enlightenment

- Time of Actual Cryptocurrency Enlightenment

I believe at the time of that presentation in May, bitcoin was worth approximately $2200 USD. Couldn't go up much further than that...

Fast forward to the beginning of the Bitcoin craziness in November-December (Point #2 on the above chart) and one day I said to myself - why don't I just try getting into this and see where it leads? Just put in a bit of money, and see what I can learn. It wasn't like I was mortgaging my house for crypto!

Even though I got in at a very high time, I have managed to learn quite a lot, and my portfolio definitely grew significantly from what I started with. Fast forward to now, when some would say the market is in mid crash, and I am still about even. There is so much to learn when trading against Bitcoin when Bitcoin itself is also fluctuating. It can become challenging to determine when a sell is profitable. For example, buying a coin at 500 satoshis and holding it for a week, then selling it for 1000 sats generally seems profitable. Double your money in fact! But, you should also be checking what the relative value of Bitcoin is when selling. If Bitcoin dropped in half in that same period, you will only be breaking even when comparing total USD.

Maybe this isn't important to some people and the accumulation of BTC is the more important metric, but it is definitely something to make sure you understand. I'm a long way from being comfortable, but getting there.

Anyway, the point of my post was actually to relate how challenging I found it to get fiat currency into crypto. Since I opened my accounts on various exchanges (Bittrex, and Binance for example) before they closed down the ability to open new accounts, I didn't have to worry about becoming a member of those exchanges. Yay!

Of course, the de-facto way in for beginners to get fiat into the market is Coinbase using a credit card, and pay the additional and expected, 5% fees. As a Canadian, it's important to realize that this is currently a one-way trip. Money can go in, but you can't currently get it out.

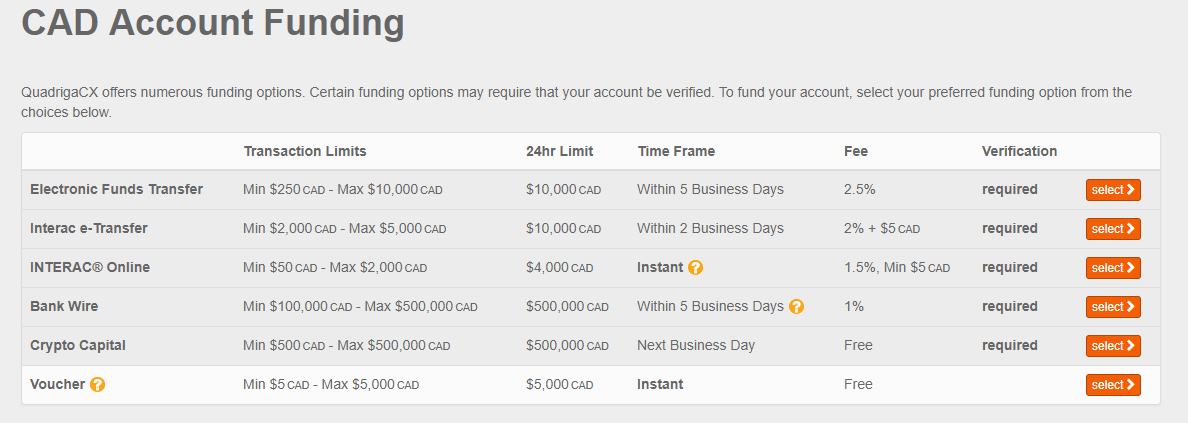

My second option was Kraken, but the website was suffering from showstopping performance problems causing me to look for other options. Enter QuadrigaCX. Now they had many options to get money in:

Easy! I will use the super-easy Interac E-Transfer! Only have to pay 2%+$5 extra to do that. Cheaper than a credit card on Coinbase! Selecting that option enlightened me to the reality that Quadriga was also having scaling issues due to the number of newbies like me trying to get into the market. The e-Transfer feature was turned off while they looked to automate the process. Hmmm...

Ok, let's try what I would believe would be the next easiest option, Interac Online. As my credit Union was not on the list of supported institutions, I had to open an account at a supported bank, but really that was no problem. e-Transfer money to my shiny new TD Canada Trust account, and I'm cookin' with gas! Now to transfer using Interac Online!

Turns out if you read the bottom of the page about Understanding Co-badged Debit Cards you'll find that you cannot use for example a Visa Debit card. It's an Interac thing. Well, most banks now only have co-branded debit cards - or at least mine only had them. Off to the bank I go to see if they can assist me. Thanks to the assistance of a wonderful teller at TD, she converted by account into the old numbering system (pre visa-debit). That should be good!

Off I go home to give it a try again. Nope. No luck. Calling her direct line the teller advised that, sadly, there was nothing else that she could do and that I should again call the TD help line and see if there was anything further they could do. That would have to happen tomorrow as I had blown the balance of my day after my son's soccer game trying to get this working.

Next morning, I gave the TD help line a call. I explained to the very helpful man that I was TRYING... to get the Interac Debit (also called Interac Online) to work with my account. After I explained everything to him, he asked very enthusiastically if I was trying to send money to Quadriga! Aha! Someone who knows my mission! I sense success is near! "You're getting into crypto eh?" he asked. "Yes, been doing it for a bit (as if it's old-hat to me), but trying to setup an account so I can get fiat in and out easily".

The very helpful man then proceeded to explain to me that he had tried to do the same thing with TD, and couldn't make it work. He said he ended up opening a Tangerine account, which was easy to do and didn't have a co-branded debit card so it was able to do Interac Online. He also added that, as a Canadian, he likes using Coinsquare.io to do his crypto funding rather than Quadriga as it was even easier, rates were better, and there were even more funding options available there.

At that point, I was fairly certain and comfortable that I wasn't going to be successful using TD for Interac Online purchases. I ended up thanking him for all of his valuable assistance, we shared some thoughts on some micro coins and good platform coin technologies, and that was it. I then proceeded to open a Tangerine account and revisiting my Coinsquare account which I already had. One of their funding options was a bank draft. Only had to pay a 0.25% fee. Sweet!

In order to get my money out of the TD account, I ended up going old school and getting a Bank Draft from TD. They waived the fee after hearing the amount a time I spent trying to get the Interac Online to work. Nicely done TD. They were in fact great to deal with despite the fact I couldn't make it work.

Finally, as I type this, I am still waiting for Coinsquare to add the funds to my account so I can begin trading. Fortunately for me, we seem to be working our way through another dip in the markets, so hopefully I can ladder in at some great sale prices soon!

Oh, and any recommendations, fair reader, on where I should be putting my well-traveled cash-ola?

Thanks for reading!

Congratulations @clintfromcanada! You received a personal award!

Click here to view your Board

Congratulations @clintfromcanada! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!