Will Bitcoin Go Back Up? February Price Predictions

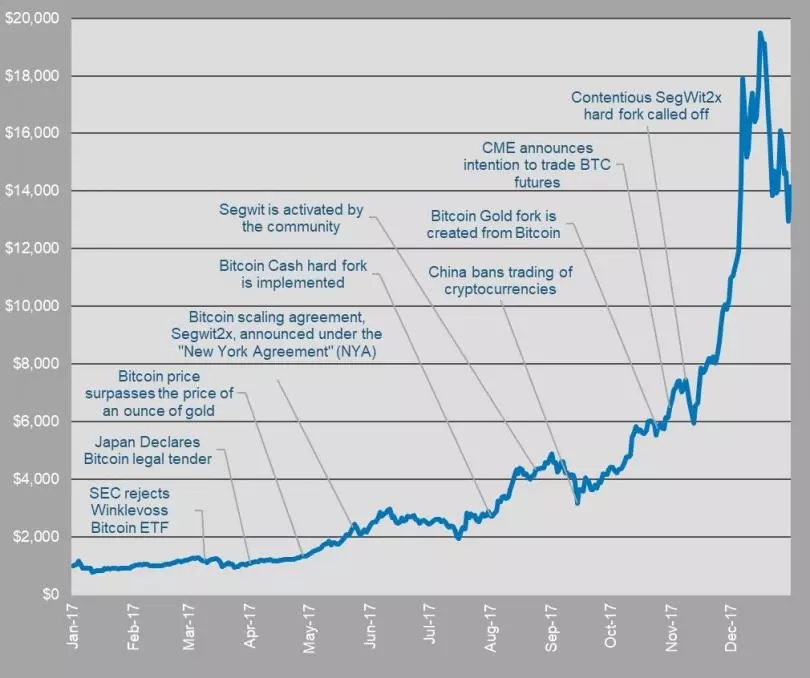

Bitcoin costs dropped significantly finished the previous week, down 10 percent to a normal of $10,019 by Wednesday morning, as indicated by OnChainFX. Despite the fact that bitcoin's general money related grew 900 percent amid the previous a year, up from around $956 on Jan. 31 a year ago, such sensational vacillation still makes examiners and experts uneasy

A few elements played into the current plunge, including an embarrassment identified with Tether's dollar-pegged digital currency USDT, which a few examiners accept was utilized to buy bitcoin and misleadingly expand bitcoin's cost. In late January, one mysterious USDT report evaluated bitcoin's cost would have been nearer to $2,000 without such control. Albeit such claims ought to be taken with adequate salt, a 2017 report by Digital Asset Research assessed bitcoin's genuine esteem would be nearer to $2,074 in 2018.

"That number speaks to the blocks and mortar utilize cases, times the piece of the overall industry rate, in addition to each of those utilization cases time their piece of the pie," Matthew Gertler, senior examiner at Digital Asset Research, disclosed to International Business Times. "This is taking a gander at bitcoin as an administration, essentially, as an item… this is a scholarly exercise... it's difficult to state these numbers could be truly depended on." It's likewise vital to take note of this scholarly model does not factor in bitcoin's essential utilize case as a store of significant worth. This displaying was like how financial analysts assess organizations, not monetary forms or resources like gold.

Most bitcoin aficionados trust advertise costs are really the minimum intriguing information point about this digital money. Numerous clients "hodl," or store their digital currency as a long haul speculation they don't plan to touch for a long time. Then again, numerous digital currency merchants now make their living by utilizing here and now instability. They regularly find customary market factors don't make a difference to digital currency.

"A ton of the digital currencies are connected among themselves. However, as far as other customary, existing markets, it doesn't generally track them [digital currencies]," Gertler said. Direction, media patterns, claims and new venture items, for example, bitcoin prospects all effect bitcoin's theoretical market cost. Significantly Twitter fights and contentions on Reddit can affect open impression of this rising resource class. Digital money trades in a few nations, for example, South Korea and Zimbabwe, routinely offer bitcoin for 10 to 50 percent more than normal worldwide costs since neighborhood request is so high.

"There is connection between's exchange volume in Korea and distinctive cryptographic forms of money," Gertler said. "You could take a gander at Korean exchanging volume being a market pointer for future cost increment. It's very less so now, so it is misty if that still holds."

Money Street veteran and digital currency financial specialist Jill Carlson revealed to IBT advertise microstructures impact bitcoin's value instability. "It's extremely juvenile, so you have an exceptionally worldwide market but an extremely divided market," Carlson said. "You'll get tremendous disengagement in cost from trade to trade. There aren't generally great methods for arbitraging those out."

IBT gathered information from Jan. 25-30 of more than twelve back specialists to get their finish of February 2018 bitcoin figure. Their normal bitcoin value expectation remains at $13,000.