How to achieve a 90% winning ratio trading altcoins.

More money is lost to ignorance than anything else.

Would you go head to head against the world’s greatest chess player and expect to win, in defiance of the fact that you barely know the basics of chess? Furthermore, would you take your life savings and then bet them on the fact that you can defeat this world class player, despite never having won a single game of chess in your life?

This is exactly the kind of behaviour we see from novice traders.

Often you will find that it is the novice traders prosperity in the realm of ignorance, that forces them to make terrible decisions in the altcoin market.

I champion the notion that trading altcoins is the fastest and easiest method of making money, however, this is only true for the traders who have an understanding of market psychology and the mechanics behind price movement.

These skilled players understand that their success in this market boils down to two things: positioning, and duration.

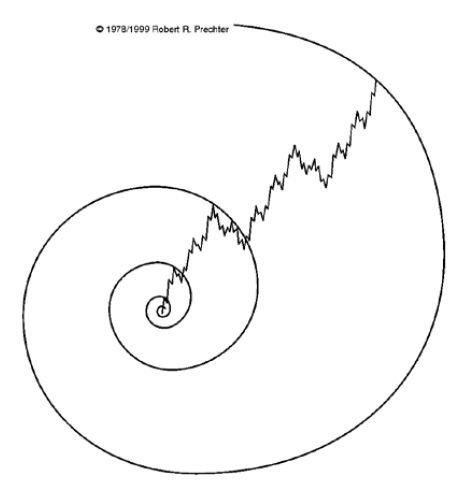

If you are attempting to trade this treacherous market, then you must understand that there is a structure to the way money flows into and then out of each and every coin. This structure never changes, and so is very simple to master.

Patterns that work

- have patience

Things dont happen every day, nor every week but it happens fucking frequently!!!

- do not day-trade!.

Pay attention to the monthly volume of BTC flowing through the market not the daily!.

- find exploitable and recurring price patterns

Skilled traders will never place a trade without having noticed a recurring, thus exploitable, price pattern.

These exploitable price movements occur over and over again, making it simple to gauge the most optimal buying-in price.

- spot intelligent accumulation

Now. Whilst the novice avoids low volume coins. The skilled player realises the difference between a dead/dying coin, and one that is being accumulated in preparation of distribution.

The skilled player understands that every coin has its maximum capacity in terms of volume, thus coins with an above average 24hr trading volume are not looked upon as profitable opportunities – unless there is above average demand (which is rarely the case - Markets are in trend roughly 30% of the time and 70% in consolidation).

Long term players understand that the best time to buy into a coin is off the back of a major decline.

- buy after huge panics have settled (so called pre-pump prices)

Long-term traders sit back and laugh, because they trade less, but make more money month after month after month.

They know that they are in the minority. Which literally means, they have no competition.

A long term trader will open a trade today, with all the intent to remain positioned in that trade for a month or two or even longer!!! The coin may jump in price within a day, a week or 30 days and they can cash out and take their winnings – but, the point is, their original intent is always to remain positioned in that coin over the long-term… because, by doing this they are exposing themselves to capturing a portion of the monthly trading volume that pours into and through this very market, while day traders are constricted and limited to only working with the meagre ‘daily’ volume.

So clearly, this means that the very minute that you decide to adopt a long-term strategy, you have instantly increased your chances of success. You have widened your scope for profit, and constricted any window of failure.

Simply put, when you begin to expand the duration of your trades, more money instantly becomes available to you

sell into spikes

sell into parabolics

Recurring patterns occur in every single altcoin in the market and, if you are to pull more money from the market than you put in – you need to come into alignment with the natural flow of the market.

A coin tends to attract multiple BUY ORDERS – at, or close to the current market price – during a distribution phase of the market cycle.

As the price rises, you begin to see bidding wars take place in the buy side of the orderbook – with each new buy order tightening the spread.

Eventually, you have a situation where 20+ btc of legitimate buy orders consume the buy side.

This action only occurs during distribution, as laggards, novices and latecomers rush to get in on a coin that is already trading at a severe mark-up.

In the mind of a novice, such a large amount of buy orders can only mean one thing. The price can’t fall, because there is “good support” or because this coin “looks strong”.

A skilled trader will have the easiest of exercises to liquidate his supply to the retail trader

with a considerable markup.

No one can stop the flow of the market.

Sure, you can redirect the flow, stall it for a day or two… but, the current of the market is just too powerful. It will break through every barrier that can be placed in front of it. If you are trading against this flow, you will lose. You will be swept away so quickly that it wouldn’t even be funny (unless you’re on the other side of the trade that is).

If you are in sync with this pattern of movement, you will make more money than you ever thought possible. You will be leveraging the markets own movement and momentum to plough large amounts of bitcoins into your wallet

These patterns are being exploited on a daily basis.

You nailed it on the head. My problem is I'm never sure when to sell!

I gonna go into more detail on that in a post of its own. Make sure to follow ;-)

Been following for a while now bro!! Hope you're the same haha :)

Me too. Need to learn how to spot the selling point. Waiting for your next post Ryan

Yeah me too. For the next post it would be nice to read how you use stop loss if you do. If you decide your exit strategy beforehand (for ex. do you sell at 100% gain, 50% of the coin, or just sell all at once at one specific point?).

You are the master trader :)

By reading this post, as a novice, I learned something man! I wish I could learn how to trade in this market. Looking forward to read more of your posts.

thanks man!

great post, followed!

Thank you!

Interesting read once again, reminding us to be elite trades and not novices. Cannot wait to see your in-depth article of what you used to teach in your ELITE coaching. That Sam Seiden guy that you have linked in a couple of your post has been really helpful with understanding the markets more, you two seem to have the same idea on how these markets work. Thanks for the information!

Indeed I do have the highest admiration for Sam!

Are there other people with a similar mindset of which there is online content? Or someone you think who is knowledgeable.

That dude...Buyer Beware :)

show us your millions :-)

Hey Ryan, I've been reading all of your posts. New to the crypto game here but my partners and I were wondering if you are still offering coaching? Potentially interested. Please keep putting out these knowledge bombs although I wouldn't mind paying for your work!!!

Thank you very much.

read all your steemit posts theyre great! Thanks for making these

Thanks for sharing this ;)