How I Shorted The Market And Won With Huobi

Cryptocurrency continues to be a hot and trendy topic in the financial world. There has been a steady growth in the number of cryptocurrency investors because of the new doors of opportunities it brings. Around January 2018 the cryptocurrency market reached its peak when market capitalization reached an all-time high of over $800 billion (https://cointelegraph.com/news/combined-crypto-market-capitalization-races-past-800-bln), bitcoin stands out among others peaking December 2017 when it was worth about $19,783. (http://fortune.com/2017/12/17/bitcoin-record-high-short-of-20000/)

2018 has not been too good for the cryptocurrency market; the crypto market capitalization has shrunk as low as $219 billion. Bitcoin is also underperforming, falling as low as 27.8% in July 2018 and has failed to witness another astronomical rise just like it did in 2017. This has lead to skepticism towards the crypto market by both current investors, potential investors and of course the media.

Before taking a stand towards crypto investments or building a perspective towards the cryptocurrency market it is essential that you understand why the prices are falling.

There are three primary causes:

Press

Of recent, the cryptocurrency market has faced heavy criticism from the media. The cause of the fall in prices is not far from the resultant effects of negative headlines against the crypto market. New reports on cryptocurrency are filled with sentiments example is the Yonhap report on the raid on South Korean exchange Upbit. Notable economists and investors like Warren Buffett and Bill Gates are also not helping with negative comments towards the market.

Policies

The Chinese government is leading with policies that are affecting the price of cryptocurrency, its recent crackdown on all cryptocurrency activities and a total ban on cryptocurrency have affected the image of cryptocurrency. Policies from Facebook and Google also are affecting the image of cryptocurrency; in February 2018, Facebook placed a ban on all cryptocurrency advertising, Google also did the same.

The Mt. Gox Transaction

About $60 billion was lost between 15 and 16 of March 2018 because trustees of Mt. Gox sold over 8000 bitcoin worth $400 million. Such mammoth transaction inevitably would affect the price of cryptocurrency.

The saying “every cloud has its silver lining” has proven to be true in the crypto market; I am proud to say I am part of those investors enjoying the silver lining from the dark clouds. If you are wondering how this is possible, sit back while I reveal my investment tactics called “Shorting.”

Shorting as a trading technique is not new to the financial world, it is widespread for those into securities like the stock exchange; this technique has also been successfully applied on crypto broker platforms, through margin trading.

To succeed with shorting you have to know how to predict if a price will go down rather than up, this may seem easy since the prices of cryptocurrency have been on a downward fall for quite some time now.

As a short seller, you don't necessarily need to own Coins; you will be able to borrow from brokers platforms like Houbi Global. (I recommend Houbi Global because it is what has been working for me.) Then you sell the borrowed coin at the current market price, and you wait for the price to fall (as anticipated). Once the price drops, your profit will come from the difference between the current market price and the new price after it had fallen.

Here is a practical example of a BTC short transaction. Let's say the current price of BTC is at $8,000 and you are convinced that the price of Bitcoin would fall to about $7,000 soon, if you loan 5 BTC and sell at $8,000, you will have $40,000 in your account, when the price of a BTC eventually falls to $7,000 you then buy back the 5 BTC at $35,000 and repay the loan. You will realize a difference of $5,000 that is your profit. It is a direct opposite of long trading.

If you are interested in giving shorting a trial, I will advise you to short with Houbi Global, since the platform is comprehensive and easy to navigate so it will be a good place to start.

The first step to take if you want to start shorting with Houbi is, get at least fundamental knowledge on how to Margin Trade. Then you create a Houbi account or log in to your existing account. After your account is funded, you need to transfer funds from your exchange account to your margin account.

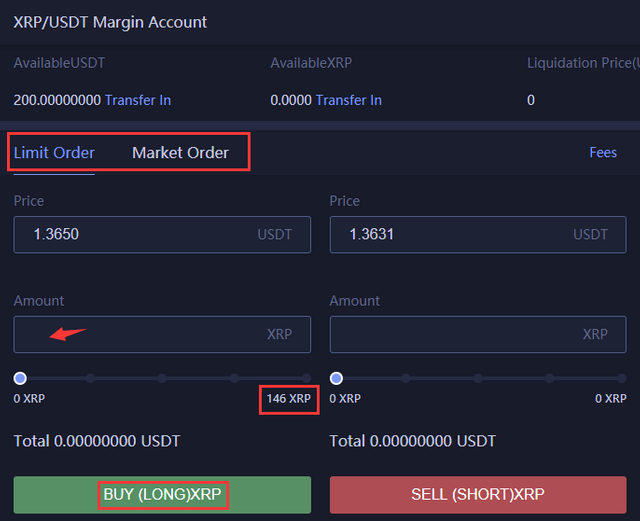

Then you take your desired amount of loan in XRP from the margin page after you have secured the loan, you can then sell immediately, selling at the current price, by either placing "Limit Order" or "Market Order."

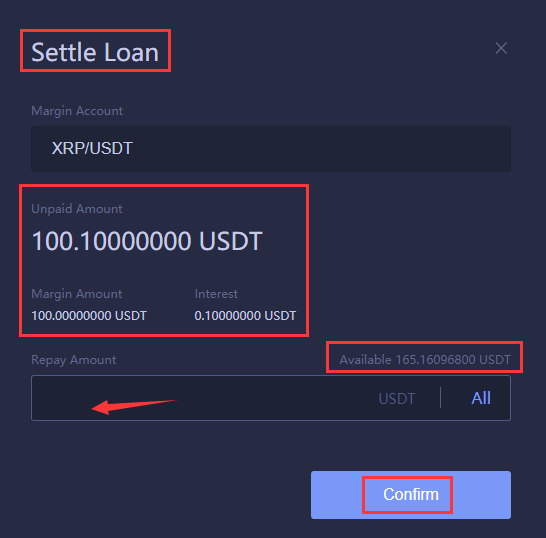

After a while, if the price of XRP drops as anticipated, you will be able to buy back and settle the loaned XRP at a reduced rate.

Shorting with Houbi is a great idea because it involves leverage. Generally, leverage gives you the opportunity to transact with little funds, but you have to know what you are doing because incorrect predictions will leave you in a more significant loss.

Other Projects Worth Shorting

Shorting BTC is the best option since it is the mother of all coins, but here is a tip if you are looking to shorting other projects. Don't just go for any coin with the presumption that since the idea behind shorting is for the price to fall, you don't just go for a coin on downward fall. What you should be looking out for while shorting altcoin is volatility. The less volatile a coin is, the easier it is to predict.

Three altcoins you should also consider shorting are Dashcoin, Monero, and Tether. The reason why I select these three coins is that I consider them the three least volatile coins, being less volatile helps you predict their future value more efficiently.