Kucoin: The Exchange-based Token That Earns You a Dollar Cost Average and Diversified Portfolio, Daily

I am the original creator of this article and the original published article can be found here on my Medium blog account.

In my last article, we dive into a bit of the history behind cryptocurrency exchanges and how they have failed cryptocurrency investors and day traders over the years. The article then dives into how Binance is leading us into an era of token-based exchange business models which, as the facts prove, are growing at an unprecedented rate compared with your typical Bittrex-style cryptocurrency exchange. A more ‘trader-friendly’ era of cryptocurrency exchanges are upon us.

Today, we’ll:

- explore Kucoin Exchange features;

- some of their innovative token features/functions; and

- why you may want to begin researching this based on principles of finance and risk management.

My thoughts are that Binance’s strategically built BNB token is was what really captured the market. The goal of this article is to help beginning traders or existing cryptocurrency traders/investors (or anybody just interested in learning about an innovative concept!) understand why using token-based exchanges can be beneficial to our trading/investing strategy.

Kucoin — The People’s Exchange

Image Source

What if holding 1 token earned you 76 tokens? Would you hodl it?

Kucoin is a newer cryptocurrency exchange that launched operations toward the end of 2017 with “the target of becoming one of the top 10 worldwide hottest exchange platforms [Source: White Paper].”

The White Paper goes on to explain how the Kucoin exchange Founders had started researching blockchain technology in 2011 and constructed the technical architecture in 2013. With that ‘reliable and extendable technical architecture in place,’ the Kucoin team was able to more confidently build a product that could scale, providing Kucoin exchange users with an enhanced experience while maintaining course to becoming a Top 10 global cryptocurrency exchange. Add a CEO from Ant Financial of Alibaba Group who is a veteran of financial solutions to the mix and existing cryptocurrency exchanges are poised for disruption.

Just 3-months into their expedition, Kucoin has attained a whopping 300,000+ user registrations — a growth figure we’ll only hear from Binance Exchange who reached over 3,000,000 in 6-months. Binance has also temporarily suspended user registrations in order to upgrade their infrastructure and handle the scaling — should be interesting to see if Kucoin will need to do the same. Anyway, let’s examine their innovative token and how holding the Kucoin Shares (KCS) token can earn you 76 token just for holding, daily.

Kucoin Shares $KCS: One Token To Rule Them All?

Kucoin Shares (KCS) give day traders and crytpocurrency investors another very powerful reason to use the exchange — KCS holders receive 50% of the trader fees collected from the currently 76 cryptocurrencies on the platform and a discount on fees. This is pretty powerful considering Binance became the #1 cryptocurrency exchange within just 5-months with a similar business model, garnering a 24-hour trading volume of $9,297,690,547 and over 3-million users.

Just a week ago, Kucoin’s overall 24-hour exchange volume was $50 million. A week before that it was around $20 million. Today, that metric sits at $166,957,272.

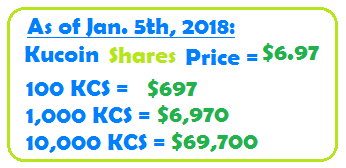

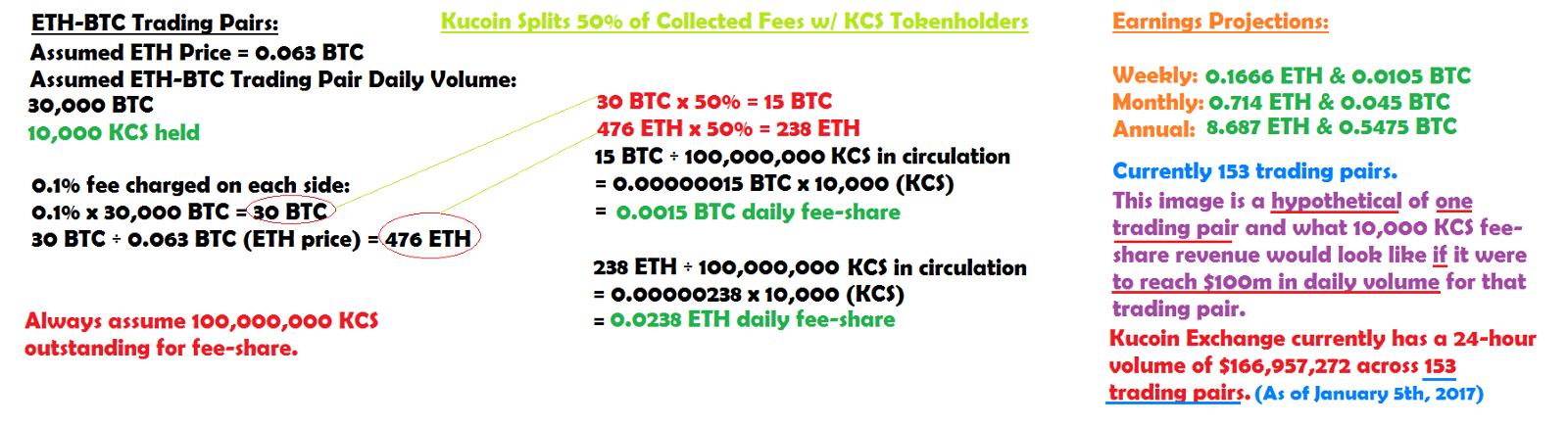

The platform takes just 10% of fees while sharing 40% with users who have referred others and 50% of the fees collected on all trading pairs with KCS tokenholders— let’s look at an example of what an the ETH-BTC trading pair looks like with the daily 50% KCS fee-share, holding 10,000 KCS tokens.

Kucoin Exchange

As you can see in the example above, holding 10,000 KCS can earn the tokenholder 0.0015 BTC and 0.0238 ETH daily based on a 30,000 BTC 24-hour volume for the ETH-BTC trading pair. This example is just for ONE trading pair and Kucoin currently has 153 total trading pairs out of the 76 coins on the exchange.

If you’re investing/trading cryptocurrency, you have likely heard about the concept of portfolio diversification as a means to hedge the risk of the overall portfolio decreasing in value by combining a number of uncorrelated assets. Considering cryptocurrency is more closely correlated with each other than stocks might be, we gotta really get creative to smooth out the level of risk we face in this market — this makes it harder for diversification to save us from losses because a vast majority of cryptocurrencies trade against Bitcoin which is highly volatile.

More on Diversification

The idea is that when some positions in the portfolio decrease in value, other positions increase with aim to make up for the decrease in other positions of the portfolio.

Mutual funds are probably one of the best examples of how diversification can successfully lower the risk of an investment, making it a safer investment as opposed to investing in just one position in a mutual fund. For example, a mutual fund might look something like:

- 10% commodities — 5% Gold, 3% Silver, 2% Oil

- 30% real estate — 50% multi-family housing, 50% commercial shopping centers

- 5% foreign currency — 33% USD, 33% EURO, 34% GBP

- 55% stocks — 25% Apple, 25% Amazon, 25% Google, 25% Walmart

Now, this is just an example from a high-level of understanding and is not financial advice — the idea here is that commodities, real estate and foreign currency tend to be less risky investments and they can smooth out some of the volatility from the stock market portion of the portfolio.

Cryptocurrency is extremely risk and this is the reason we see major increases and decreases in price — higher risk = higher expected return.

The principles of finance say the more risk we take, the more we are supposed to earn.

Based on real Kucoin Exchange statistics, the example below depicts what one day’s earnings might look like from holding 10,000 KCS, across 6 trading pairs:

Top 6 Kucoin Exchange Trading Pairs

It’s hard to show you the power of holding KCS without using long-term projections, but imagine earning daily micro-payments from 76 different cryptocurrencies.

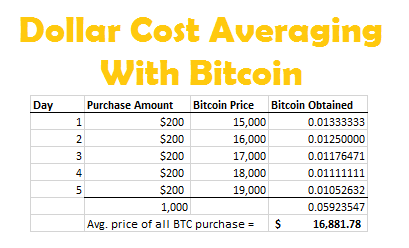

Dollar Cost Averaging is another way to hedge the risk in a single position by buying it at various prices with the intention of an overall lower price paid per unit for that asset. This combined with portfolio diversification can be extremely powerful.

Notice in the example above, on day 5 the Bitcoin price is $19,000; however, having purchased it over 5-days at $200 increments led to an overall average price of $16,881.78 per Bitcoin.

Kucoin Exchange

Remember, Kucoin currently has 153 trading pairs comprised of 76 cryptocurrencies with goals to list over 1,000 cryptocurrencies at an expected 100,000 BTC daily volume by the end of 2018.

Now imagine earning 76 (1,000 in a year) different cryptocurrencies everyday for holding Kucoin Shares — that’s like daily Dollar Cost Averaging an extremely diversified cryptocurrency portfolio. Oh yeah, they have NEO and USDT trading pairs — earning USDT & NEO from trader fees collected from those pairs.

USDT is less risky (more stable) and not as correlated with the asset that cryptocurrency is, leading to a more stable position within the portfolio. NEO earns GAS every 30-seconds — think of this as a daily dividend. So even if NEO were to fall in value, the holder is still earning 0.00000008 GAS per NEO held every 15 to 30-second block.

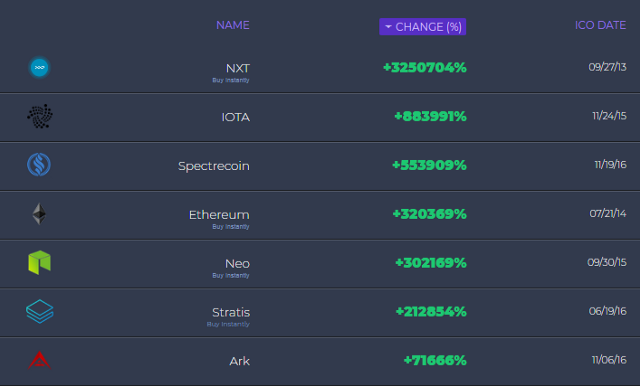

Even more, take a look at the image above from ICOStats.com. The lowest ROI since ICO of the Top 30 ICO’s goes down to 2,728%. This means that at least 30 Initial Coin Offerings have provided ICO investors with a minimum of 2,728% return on their investment. While risk can destroy us and our portfolio, we can also use it to gain more profits.

If Kucoin Exchange is successful in reaching their targets, holding KCS can earn you 1,000 different cryptocurrencies across various trading pairs, daily. Kucoin is working on a way to allow users to list their cryptocurrency automatically without taking resources from the exchange — in addition to everything mentioned, this creates a potentially very profitable opportunity over the long-term as the exchange grows exponentially.

If you’d like some context on cryptocurrency exchange history, check out my last article and make sure to follow along on Medium!

- Binance Exchange: Fueling a Hot New Era of Token-based Exchange Models?

- Follow CrowdConscious on Steemit

- Follow CrowdConscious on Medium

The best way you can support me right now is by signing up for Kucoin Exchange via my referral link or by sharing this and/or any of my articles. I’m getting closer to my goal of living fully on cryptocurrency which I will begin covering once I have achieved 100% dependency on cryptocurrency.

Until next time!

Below are some resources for beginning cryptocurrency enthusiasts or others interested in something new:

- CoinPayments — Receive and make payment via 70+ different cryptocurrencies — the crypto-PayPal.

- CoinMate — great Bitcoin Exchange for those who reside in Europe, the EU and surrounding area. Very easy to understand.

- CoinTracking — Your personal Profit / Loss Portfolio Monitor and Tax Tracker for all Digital Coins or cryptocurrency. Bitcoin, Ethereum, Litecoin, altcoins, etc.

- Changelly — the ultimate fiat-cryptocurrency exchange to buy/sell instantly with credit cards, for anybody, anywhere.

- HitBTC — great exchange for trading various cryptocurrencies and operational since 2013.

- Bit-Z — Newer Top 20 cryptocurrency exchange adding new, ICO coins all the time.

- CEX.io - Buy Bitcoin w/ credit card, ACH bank transfer, SEPA transfer, cash, or AstroPay. Credit purchases are instant.

- CoinMama- purchase Bitcoin and Ethereum w/ credit/debit cards & using cash through WesternUnion on their platform. Best for Euro purchases.

- Cryptocurrency Resource Telegram Channel - Telegram channel dedicated to providing beginners or experienced cryptocurrency traders with alternative resource options. Exchanges, hardware wallets, tax resources, etc.

- Ledger Nano S — multi-cryptocurrency cold hardware wallet supporting Bitcoin forks. Keep your coins safe and offline. Cold storage.

- Kucoin Exchange - Binance's 'little brother.' Very similar with trading competitions and whatnot. Revenue share token as well!

- Binance — the up-and-coming cryptocurrency exchange that has truly entered as a leader among exchanges. Tons of benefits, a trader’s must-see.

i think coming years are the years of crypto.

can you tell what is mining? want to know.I'm a beginner

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://keepingstock.net/kucoin-exchange-based-token-that-earns-you-a-daily-dollar-cost-average-and-diversified-portfolio-2f532a432ed1

bro i like your post