Circle buys Poloniex for roughly $400 million

In big news this morning, Circle announced the purchase of cryptocurrency exchange Poloniex.

Circle is a cryptocurrency financial services firm.

It also just so happens to be backed by Goldman Sachs.

This could be the start of something very big for Circle and Poloniex as they join forces to compete against the likes of other large US based cryptocurrency exchanges.

Coinbase and Bittrex are the main two that come to mind.

Robinhood also hopes to put its hat in the ring with over 3 million users, but they are only starting to adopt cryptocurrency trading just recently.

What this means going forward?

The acquisition should greatly boost Poloniex's customer service abilities which have been lacking, to say the least and put it nicely.

However, it appears that Poloniex and Circle hope to become much more than just one of the better cryptocurrency exchanges.

Check out their quote on what they are hoping to be going forward:

"We envision a robust multi-sided distributed marketplace that can host tokens which represent everything of value: physical goods, fundraising and equity, real estate, creative productions such as works of art, music and literature, service leases and time-based rentals, credit, futures, and more."

(Source: https://www.coindesk.com/circle-acquires-poloniex/)

Wow!

It sounds like they are hoping to be the bank of the future.

The crypto bank of the future.

More from the official release can be found here:

https://www.newsbtc.com/2018/02/26/goldman-sachs-backed-circle-acquires-poloniex-crypto-exchange/

On top of all that, cryptocurrency investors seem to mostly like the news:

(Source: https://www.coinbase.com/dashboard)

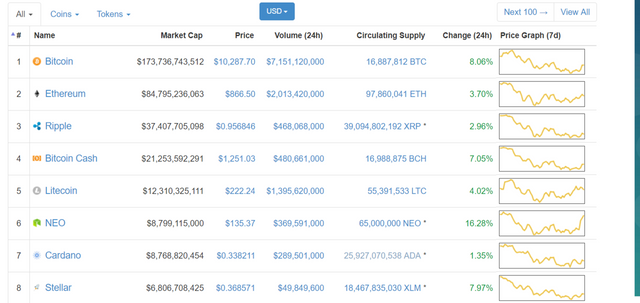

Bitcoin shot up close to 900 points (roughly 10%) from the time the news was announced until now.

Most of the rest of the cryptocurrency markets are nicely in the green as well:

(Source: https://coinmarketcap.com/)

I am excited as a Poloniex user as well a cryptocurrency investor.

I think this is part of cryptocurrency becoming more widely adopted and widely held, and I also think this will help push fees at the exchanges down across the board.

Pretty soon exchanges will start engaging in a "race to the bottom" in terms of fees in order to attract more users.

That is a race that users ultimately benefit from.

Competition breeds better prices for consumers.

Stay informed my friends.

Image Source:

https://www.newsbtc.com/2018/02/26/goldman-sachs-backed-circle-acquires-poloniex-crypto-exchange/

Follow me: @jrcornel

If you can't beat them, buy them! Here come the big banksters to the crypto party!

I do totally agree, that's really a shame. I will definitively stop using Poloniex. Goldman Sachs are BANKSTERS ! They have a lot of blood on there hands. That's the saddest news I have heard today.

This further supports many thoughts that Wall Street has been playing both sides like the good old trading days (similar to Junk Bonds). Slam the asset class you want to get involved in, to buy cheap and to go long, establish strategic positions and then formally support the asset class through M&A, cap markets, market making (legitimacy/liquidity), research/analysis (recommendations) and long term investors (individuals/ investor funds). We have heard that prop desks have been going long crypto. Now with this acquisition, GS is clearly supportive and indirectly involved (due to regulatory issues, they should not directly own, etc.) . Another step towards legitimacy. Lets now see what JPM, CB and the others do. I upvoted to rank my comment higher for your thoughts.

Those are some pretty good thoughts. Goldman may not like the idea of crypto, but they like making money even more, so they will follow wherever money can be made.

Quite true. GS will take all sides of a transaction!

Ironically, GS senior strategist global investments came out with a bubble prediction --> Yesterday!

https://www.facebook.com/goldmansachs/videos/10155852419177247/

As they say, watch what they do, not what they say.

Interesting thing here is now we can put down a valuation for a U.S.-based exchange based on their volume. Poloniex had $152 million in volume last 24 hours vs Kraken $375 and Coinbase/GDAX $450 million. So you could argue Coinbase is worth 3x of Polo and therefore $1.2 billion.

Great points and likely get a greater multiple given their sponsors and that they are US based. It's def starting.

Its crappy news to hear the Shadow government Rothchilds owners of GS are getting into the crypto, perhaps to launder their dirty money?

Its good and as you note, its bad. They need to keep an arms-length given all the regulatory issues. My sense is that they will utilize it for private client investments and assess the regulatory and tax issues as things become more formalized globally. the beauty is that they can't corner this market, even with the other big banks.

great post @jrcornel, thanks for sharing. I added a few things that i thought would be good to know in a post of my own as it was just too much for a comment. Please take a look when you get a chance!

https://steemit.com/crypto/@liotap/circle-s-poloniex-acquisition-and-meaning-going-forward

wow this is good news for crypto's

Do you think that this will make poloniex the largest exchange in crypto world?

like everything else they have been there from the beginning this can be akinda of formal notice of here we go :) which gives even more value to the public Crypto Coin market and as they all come aboard because it's all about greed they won't be able to resist wait it's gonna be a mad dash, so better invest now and make a few dollars for the future.

i have only 1 vertcoin that is all the money i have in the internet because the banks where i live block transactions. You think i should keep it?, it worth to keep money in this exchange?

I hope they will improve as I use this poloniex site for quite some time.

Recently I had a problem with zcash when I deposit and after I made a support ticket to them they resolved the issue. I am very happy about that...but I still have a ticket for about 53 days relating a siacoin depozit to the poloniex site.

I hope at least things will improve as this will be in their interest because wihout clients the site will fail.

Buying a large exchange like Poloniex is an important step in Crypto world.

Circle is a company held by Goldman Sachs which is one of the largest banks in the world, and it's just the beginning.

I think we will see similar actions like this in 2018 as many banks will start buying Cryptocurrencies or generate their own tokens or buy crypto companies or even create their multi-function platforms.

Not only banks but also large companies as we saw Telegram created TON (Telegram open network) and LINE app will create a crypto exchange at the end of 2018 and IQ option forex broker created also OTN token (Open trading network).

That's why I see 2018 is crypto revolution year.

I'm so happy to see this news

Thank you @jrcornel for sharing this news and info with us :)

That is very good news on many levels. It will be good for crypto investors in general, but perhaps most importantly, because Goldman Sachs is involved, it may mean that cryptos are here to stay and won't be banned by the U.S. government.

terrible news, but most people have moved on by now from poloniex, this was probably a money grab, hand over and then closed doors in two years.

Haha not even close. Read into it a bit ;)

i'd rather not get involved in drama.

This is great news. I sent 12 STEEM over to Poloniex a month ago and they lost it. Still waiting for their customer service to get back to me.

Circle have experience in peer-to-peer financial transactions...So the experience and financial backing by circle is a good thing for Poloniex..

However the reservation of a centralized exchange instead of de-centralized one stands.

Yes there is still that. Also there is still the issue of Polo not getting their Steem and SBD wallets up and functioning... again.

They will get it up, I hope...for their own sake