Buying and Trading Real Estate Online with Blockchain

Today’s changing economic conditions increasingly demand that you have diversified incomes. Finances can change on a dime, and a single stream of income doesn’t guarantee financial security anymore. Especially not when planning for your future. To ensure the current and future financial security, investing your money in proper channels is essential. Not only do your investments bail you out in case of a financial emergency, but they also increase your wealth to offer a secure future. Property, shares, bonds, cash investments, etc. are some of the most popular investments used for wealth-growth.

Of these, real estate is a particularly great investment option. Real estate investments often come with minimal risks, as they are physical assets with fairly consistent demand, and therefore far less volatile than stocks. This grants investors more control over their assets and allows them to generate multiple streams of income. Investing in a property also often comes with tax benefits from owning and depreciating real estate assets – a valuable asset when maintaining wealth growth. With tangible assets in your portfolio, you can enjoy a risk-averse wealth generation system.

Real Estate Investment Trusts

However, while investing in a tangible asset has the benefit of more secure profits, it also comes with maintenance needs. For investors who don’t want to deal with the hassles of traditional real estate investments, though, a Real Estate Investment Trust (REIT) is a good choice, as it presents an alternative investment vehicle. REITs are organizations that pool capital from multiple parties, and invest the combined wealth in property. REITs commonly manage data centers, offices, hotels, apartments, villas, etc. Investing as a combined trust enables you to earn returns from property without buying or managing it yourself – alleviating many of the concerns in traditional real estate investments. REITs shares are also traded on the stock market, increasing liquidity for investors. In many ways, they combine the best of both real estate investments and stocks – lower volatility and some voting rights in relation to the property, with the liquidity of the stock market and no need to know all of the ins-and-outs of real estate law.

REITs are broadly categorized into three types

- Equity REIT: REITs purchase properties and generate income through rent

- Mortgage REIT: Properties are mortgaged to generate income

- Hybrid REIT: A combination of both equity and mortgage models

What are the current problems with traditional Real Estate Investments?

Real estate investing can be complicated and demanding, and home buyers or investors need to consider the financial risk, requiring a high level of due diligence. So, while real estate investments greatly benefit investors, they come with certain challenges. The most concerning challenge for many is avoiding fraud. Some realtors forge property documents, such as sale deeds, ID proofs, bank documents, etc. and sell the same property to multiple people. Whether you are investing $500-$5 million in property, properly identifying and establishing ownership is essential, and often difficult. For sellers, proving the ownership is cumbersome, and increasing government regulations adds to the complexity. In order to audit this system and protect against fraudulent sales, every property deal involves middlemen. These intermediaries include, but are not limited to, brokers, bankers, notaries, title companies, appraisers, escrow companies, and inspectors. Selling or buying real estate not only takes time to be processed by all of these parties, but also rapidly adds to fees.

Global investments pose additional challenges. Each country and region operates under a different set of guidelines. So, to invest, you have to know all of these guidelines, as well as the different currency values. While the entire investment system requires a large amount of personal data, global investments generally add to the number of entities collecting and storing your data, usually in their own centralized database. These centralized management systems are vulnerable to hacking attacks, leaving you open to identity theft. The inefficiencies and security concerns in the present real estate market stand to be improved, and, with the advent of blockchain technology, the means to disrupt and improve this market segment has finally arrived.

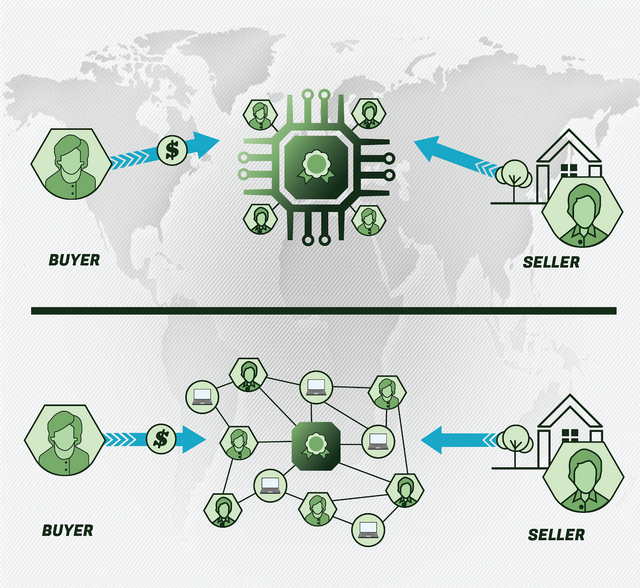

Blockchain technology is an open-source decentralized and distributed ledger. Transactions are recorded on blocks in an immutable format using a peer-to-peer (P2P) network architecture. As the transactions are immutable, the largest blockchains use a decentralized system of mutual user consensus to approve information and protect against false or malicious additions. So far, blockchain networks are most famous for facilitating the easy exchange of currency between two otherwise unconnected users.

Blockchain for Real Estate

Blockchain technology eliminates the two important concerns for investors; trust and transparency in record management. By digitizing and tokenizing assets, this technology enables real estate companies to easily sell and manage assets.

Tokenization

Tokenization converts physical assets into digital assets. In real estate, a company divides an asset into tokens and sells these tokens to multiple people, representing property or shares in a property. The digital tokens are assigned details, such as transaction history, token value, ownership details, and compliance rules for the issuance and distribution of the tokens. Assets can be digitized as a whole, or broken into multiple entities, making them ideal for shared assets or investments. Transactions are then immutably stored on the blockchain, completely eliminating fraud or multiple sales of one asset; to forge a record, you’d have to make changes to the ledger on thousands of computers simultaneously.

Secondly, tokenization of assets enables real estate owners to quickly and efficiently process real estate transactions. As blockchain technology is based on a P2P network with transactions and records already visible to participants, it eliminates the need for many of the middlemen currently involved in real estate deals. The absence of middlemen expedites this process, while the security that blockchain provides makes this possible. For instance, as tokens are easily customizable, embedding some of the processes and audits normally performed by third-parties is simple. And of course, cutting out middlemen also reduces processing costs. This benefit can be passed on to the investors in the form of lower minimum investments. This opens up investing and REITs to a broader range of people, especially those who are looking to start investing for the first time or to further diversify their investments.

Another important aspect of blockchain-enabled investments are the “trustless” transactions. Trust does not have to be established between the respective parties before, because in a trustless system, there are fail-safes to protect you. Blockchain technology has been largely successful in this goal, and allows for seamless transactions between disparate users, even in a market of high-value assets, such as real estate. And, because blockchain is decentralized at its core, global transactions are streamlined. This opens up smoother investments to more countries and regions, assuming that the blockchain platform you use has high compliance processes.

Therefore, while blockchain offers amazing benefits to investors, it is still key to choose the right blockchain platform.

How does Realio overcome these challenges?

Private equity markets lag behind other investment opportunities in the tech revolution, especially compared to stock trading and public markets. Realio bridges this gap by leveraging blockchain to provide a real estate investment platform. This platform extends global access to quality investments that deliver consistent, long-term revenues.

While blockchain companies still struggle from stigma spurred by the wave of bad businesses and investments that swept through the unregulated market, there are several steps you can take to vet blockchain companies. For instance, when investing in a blockchain-based business, the first thing to check is whether the platform is registered with the US Securities and Exchange Commission (SEC). Realio is SEC Compliant, so your investments are secure and protected. Realio has even gone so far as to take extra considerations in this regard, using a 2-layered approach. Fiat accounts are managed by the custodian Prime Trust, while crypto wallets are non-custodial, and can use any P2P exchange.

In addition to extremely stringent compliance measures, the Realio platform is easy to navigate and use. Whether you want to invest in an expensive mansion or buy a share in a small house, Realio makes the process simple and the fees transparent. And, the platform design makes it simple to search through the investments regardless of your age and technical expertise. All transactions are transparently performed on the platform, so that information about fees are always available.

.png)

For asset holding and trading, Realio hosts a multi-currency wallet. This wallet provides highly secure storage for crypto currencies, stable coins, tokens, etc., and the primary USD account uses Prime Trust as the custodian to keep your dollars safe. Prime Trust also offers a cold storage option, for more long-term investment storage. Realio relies on decentralized P2P exchanges to facilitate direct trade between disparate parties, and gives investors more options and greater customizability. This platform is highly scalable, and can accommodate large quantities of users. Every user must pass KYC/AML checks to be listed on the whitelist. Whitelisted users can then access the portal containing tokenized asset details. Transaction details are recorded on a private on-chain, preserving your privacy, while making fees transparent and ownership clear. The platform also continues to track ownership and transaction data post issuance. All of this makes it easy for you to generate reports at any time.

What does this mean for the Real Estate supply chain?

The untapped private equity market offers massive opportunities for blockchain-based real estate businesses. In the next two decades, the largest generational wealth transfer, up to $68 trillion, is slated to take place. And, investor demands are expected to change, as younger generations increasingly expect easy-to-use and transparent products. The current private real estate market is valued at $7 trillion, and as wealth transfers, these investments need to reassess how they reach their investors. Legacy financial institutions have shown an inability to support this changing market into a more transparent and technologically advanced future. At present, they lack the expertise and agility to tap into the exciting niche of digital and blockchain-based asset management solutions.

The Realio platform is designed for both investors and investment opportunities. It enables every member of the real estate supply chain to seamlessly tap into this niche, stay ahead of the competition, and herald in the future of investments. Realio makes digitizing assets simple and easy, and provides compliance with government regulations. Right from asset issuance and exchange to ownership tracking, Realio offers end-to-end digital asset management solutions that are scalable and easy to use. With automated trust and the absence of unnecessary middlemen, costs are significantly reduced. Realio is changing the market by enabling you to tokenize non-traded REITs and generate good returns while maintaining liquidity on par with publicly traded REITs.

Realio’s platform can be easily integrated with standard blockchains and exchanges, allowing a high level of choice for all users. And, global asset management is more accessible than ever on the Realio platform. Whether you want to digitize assets, create a token, or trade currencies, Realio is a one-stop shop for real estate investment solutions.

Promising project! modernizing custody of assets

Very promising indeed! This is the future of Real Estate!