Blockchain Technology Potential (Series 1) – A Review of a Recent PAYPAL CryptoCurrency Patent Filing and What It Means for the Future of the Technology

In the midst of the currently bearish environment for cryptographically-enabled digital currencies, or cryptocurrencies for short, this series will be looking at the less noticed developments that tell a lot about the value of this technology and point to actually a really bright future for those that position themselves correctly in its budding development.

In the first of these series, we will be taking a look at a recently filed Paypal patent, what it tells us about how they see the technology, how they may be positioning themselves, and what it might say about the future potentially.

One problem with the crypto community is that things happen so fast that sometimes many are conditioned to be impatient. Just like in 2014, many were lamenting and down on themselves for buying at the top, and many abandoned at the height of the downturn. But those who got in substantially at the time are able to retire today by 2017. In general, many new entrants into this technology expect good things to happen within weeks.

Bitcoins was at about $1200 at the height of its 2014 bubble before falling by about 80$. In 2017 many people would have been happy to have bought at its pre-crash value. Yes sometimes things change really rapidly within weeks in cryptocurrencies but the best strategy would likely be to really understand fundamentally the technology and then with true understanding make the best informed judgement. And then not second guess that on a daily, weekly, or even monthly basis. And no one does not have to be a programmer to be one of the winners of the immense change that will likely take place in the next couple of years.

So let’s get into the patent filing.

TITLE: EXPEDITED VIRTUAL CURRENCY TRANSACTION SYSTEM

PUBLICATION NO.: US 2018/0060860

PUBLICATION DATE: MAR. 1 2018

FILING DATE: AUG. 30 2016

LINK TO PUBLICATION: USPTO site link to patent

The invention in the patent is basically a way to perform an instant transaction on a blockchain that would normally require some time for the transaction to be confirmed. The idea behind the patent is to pre-split any balance a user has in their wallet into smaller sub amounts in multiple addresses on the blockchain. When it is time to make a payment and the amount is known, they simply combine those smaller balances into the payment amount and send the private keys of the secondary addresses to the other party instead of transferring anything on the blockchain. Sending the keys over encrypted media can be done virtually in an instant using an wallet App built, say by Paypal. Once the other party has the private keys to the amount then they do not need to wait for anything to be mined on the blockchain. The patent then includes provision for destroying copies of the sub-address address keys from the original owner after they are transferred.

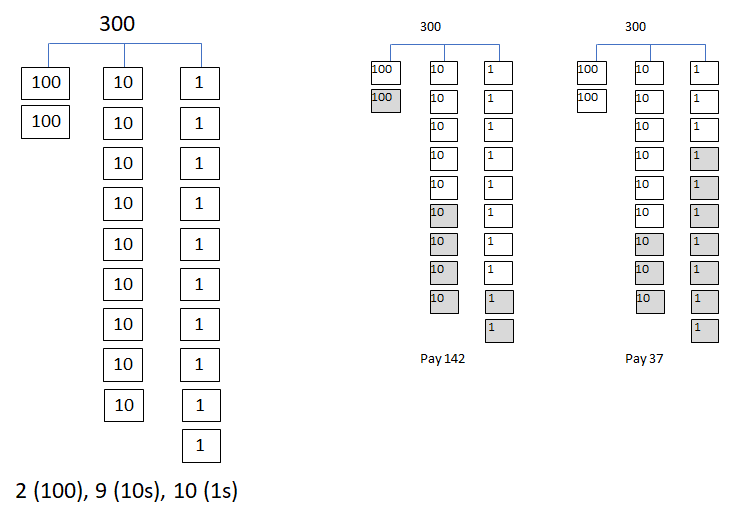

Source: Illustration by Current Author.

This paragraph can be ignored for any disinterested in math

An example of the breakdown of a balance of 300 units, for instance into smaller addresses is shown in the figure above. From those sub-wallets, any amount to pay can be composed, and the keys to those smaller amounts all sent to the recipient or merchant. For instance, in the figure, amounts of 142 and 37 units are shown. For a non-round figure such as 231, the decomposition would be into 1 (100s), 12 (10s), and 11 (1s). We leave it as an exercise to the reader why not 2 (100s), 3 (10s) and 1 (1s). The algorithm to accomplish this was missing in the patent application, but would involve some mildly nifty base 10 operations1. (Note also that the above is the author's description of how this could be accomplished.)

Continue

So basically with this method, Paypal would potentially be able to accomplish instant payment over a blockchain that needs 10 minutes for transactions to confirm, and allows an App built on that principle to be usable for in-person, in-store transactions. This is distinct from the method used currently by crypto-debit cards where you essentially transfer balances into the control of the provider from which they can essentially make payments on your behalf instantly because they control the keys to the balances. Also, this is not the same problem as scaling. Scaling simply addresses how many transactions a blockchain can handle not how fast. For instance, Bitcoin Cash improved on Bitcoin scaling by mining bigger blocks, so they can fit in more transactions in each block, but still every 10 minutes.

What Does This Mean for Blockchains and CryptoCurrencies?

This probably means that Paypal sees a potential in using blockchain for instant payments. It also means that the gap that currently exists in many first and second generation blockchains that render them unusable for in-store transactions or situations where you need to make payments instantly still needs to be addressed. No store will keep a checkout line open for 10 minutes for the customer’s bitcoin transfers to the store’s account to get mined. And much work is going on in addressing this gap including by third generation blockchains. Note that second generation blockchains like Ethereum for instance take about 25 seconds – still probably long for in-store transaction. However, centralized blockchains like Ripple and Lumens take a few seconds.

Also, third generation solutions such as EOS and Steem also do take a few seconds. DAG-type blockchains like IOTA, Byteball, and Nano are expected to take seconds as well but have barely yet being tested for any reasonable length of time in production conditions. This all shows that the entire technology field is still basically at the ground floor. Maybe first floor at best. There is going to be so many more changes and more innovations that will slowly be proven as we go along. It also means there are lots of opportunities as well. And finding those requires due diligence, and not following trading analysts for recommendations that lack understanding of the technology or the fundamentals behind it.

Will This Specific Patent Prove Important in the Long Run?

I personally doubt this. I can only surmise that this was submitted at a time bitcoin fees were low. Splitting every balance into small sub-balances is going to slowly accumulate a lot of fees, otherwise. And this method clutters a blockchain that may already have scaling challenges with more transactions in splitting balances up, and using up more addresses. The method does have a merit in that it can be built on top of any blockchain. It also maintains the decentralized solution when built on top of a decentralized blockchain. However, I expect that some of the other off-chain solutions to enable instant transactions such as Lightning on Bitcoins, Raiden and Plasma on Ethereum, and Masternode instant send methods on Dash, and centralized solutions, might prove to more temporarily fill that gap. In particular, I expect the centralized methods of crypto-debit cards, or centralized hubs of the Lightning-style networks to probably end up filling the gap until on-chain solutions mature; which will still take a few years.

If this article has inspired you towards any innovative ideas let us know below, and feel free to reference this article. All reasonable comments will be upvoted. And follow for more such articles in future, and upvote it to 100% so many more can see this content.

- This would require that for a number of order 10n, the subdivisions must have at least 10 sub items of order 10n-1.

References:

https://cointelegraph.com/news/2018-blockchain-and-cryptocurrency-outlook-expert-blog (Prediction of Current Bearish Stretch)

https://www.sciencedirect.com/science/article/pii/S1567422317300480 (Peer Reviewed Fundamental Modeling of Cryptocurrency Values)

https://steemit.com/bitcoins/@kenraphael/there-is-little-chance-bitcoins-can-sustain-any-real-recovery-until-this-fundamental-metric-begins-to-turn-upwards-again (Pointing Out Weeks Ago that Bitcoin Might Still be Bearish While Analysts Were Already Telling Followers to Buy at 11K, and 12K)

https://steemit.com/bitcoin/@kenraphael/a-review-of-a-few-fundamental-metrices-that-drive-bitcoin-value-and-what-they-currently-indicate (Some Fundamental Metrics that Drive Bitcoin Market Value)

About the Author

Ken has a doctorate in Engineering, and a master’s in Computer Aided Engineering, An IT professional, programmer and published researcher with over thirty publications in various fields of technology, including several peer reviewed journals and publications.

Legal Disclaimer: I am not a financial adviser and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only. It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs. This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

@kenraphael great information and congrat....share thanks for share it.

While waiting to read your post again. I am voting you.

Thank you. These take some time to compose but with encouragement like this definitely more to come.

that was a good and informative read.

RESTEEMED | UPVOTED | FOLLOWED | THANK YOU

Thanks for the info. It seems to me we're going to see an interesting struggle between the current 'trusted institutions' and 'trustless blockchain'. Banks and other centralized payment options like paypal have increasingly overplayed their hands with ever rising fees and ever more unfair exchangerate differences. If they want to stay on top in the midterm future, they have to find new ways of being faster and cheaper while maintaining their central 'trusted' control over new blockchain technologies. I don't think they can win that game in the long run, but they'll try for sure.

The confirmation time issue for blockchain no doubt will be solved, either by new currencies following different protocols, or by existing ones finetuning their methods. Bitcoin Cash already claims that unconfirmed transactions for small amounts are safe enough (I have no opinion other than that if someone sends me a small amount and it shows up, which is nearly instant, then it's indeed good enough for me). When buying something bigger like a washing machine or a car, I don't think a 10 minute wait with a cup of coffee is a big problem.

Agreed mostly. The need for a solution to the 10 minute wait is when in line at like a Walmart, Starbucks or other store situation with many customers waiting at the checkout. And agreed that will be solved as well.

The open nature of cryptocurrency development created a low hanging fruit for patent application by the companies that will try to shut down competition, by employing prior art with a few modifications or even none at all. Patenting software does not aid in innovation. It's more like a means of shooting down competition by big companies. @kenraphael

Yes most of these are for anti-competitive use rather than for innovation. And the blockchain technology field is particularly more open source than most due to its decentralized nature which is good. Hopefully all the good innovation in this field continue to go in that direction. In any case, this particular one might not even be so useful even if granted.

Very interesting to hear that Paypal has been working on a blockchain patent. They are obviously one of the big platforms for money Transactions. Others would be the big money conversion platforms like Ebury and Worldfirst, who convert currencies into other currencies. They run the risk of becoming obsolete.

Before the 3rd generation platforms it made sense for PayPal to do this, because the biggest threat to PayPal is a competitor who can transfer money in an easy and quick way that is safe.

So they effectively blocked a way that someone could do that on the bitcoin block chain. Arguably their biggest crypto currency competitor.

A company as big as PayPal will first of all protect their own interest and then carefully maybe add something to their services. They have much to loose, so they will be very careful and fight to keep what they have.

Yes indeed. It is a good sign that they also do see the merit in using blockchain technology and that in a few years even the big players will likely be providing services using this technology.

True, although I am also expecting it to work a little bit like market for fossil fuels and sustainable energy, so that lots of powerful players in the market will actively try to stop this change. So my question is how much will they slow it down?

Paypal already does instant payments. They will most likely be using this in the distant future as a financial setup as it can be a big help by being the chain for the transactions. It's basically an easy-to-use fintech framework and easy to pay policy. This isn't about instant transactions. This is about speeding up clearing & settlement, distributing payments, portfolio management + reporting, distribution, collateral management and fraud measures.

From what I have noticed since entering crypto in 2012 when BTC was dirt cheap, the internet will eventually adopt a currency 'virtual currencies' (they will not be referred to as cryptocurrencies.) These virtual currencies will be backed by USD. Paypal is experimenting with the all the blockchain possibilities. Paypal actually tried to make their own "Bitcoin" back in the day but they couldn't solve the double spending or the Byzantine Generals problem. Satoshi hasn't really solved the Byzantine Generals Problem except in the face of Sybil attack, but he got as close as one can get since Bitcoin is essentially Byzantine resilient at 51%. Before Satoshi's efforts, Byzantine models were around 33% resilient. This was not good enough. If we look at Ripple they are most likely under 20% resilient on their best day. Stellar is most likely more resilient than 20% on their worst day. In my opinion, we are 4 years away from anything spectacular and once it's spectacular we will never hear about it again because it will be behind the scenes. Crypto doesn't work for ecommerce for many reasons. In it's simplest form, merchandise returns would be a major headache. Furthermore, these patents are not worth the paper they are printed on. Bank of America has something like 600 blockchain patents. It's just apart of Corp America. You can be sure all banks will fork the open source code and make it their own. Doubt they will even credit the source code ;)

Thanks for the detailed and very thoughtful response. Yes indeed Paypal does have instant payment. And digital currency payments have been going on over the Internet for a long time. Blockchain does introduce a slightly different paradigm and is potentially cheaper transfer than prior methods. But is not instant for current blockchains in production and that was what the patent was attempting to address. Yes indeed BOA do have a few patent applications in this space as well. I looked at a few in the past but none of them so far look like game changers either.

Regarding Ripple and Stellar, if you have all your nodes permissioned and trusted the Byzantine Generals problem becomes less likely to be a security issue. I mean which of the IBM nodes that currently make up most of Stellar's nodes will be attacking the network? But then you have a centralized solution. So its like there currently is a trade off matrix between scale, speed, decentralization, and high security where you cant get all 4 at once at this time in any current production blockchain.

I wouldn't lump Ripple and Stellar together. A lot has changed. Stellar is running on new code and algorithm. Unlike, Ripple, they designed the system to be fully responsive, but not at the expense of correctness. Stellar's new consensus protocol takes things to the next level with their Federated Byzantine Agreement approach. With this, each node chooses its own quorum slices. The slice selections and nodes are required to maintain a balance between liveness & safety. It's undeniably the 1st provably safe consensus mechanism with the four key properties (1)decentralization, (2) low latency, (3) flexible trust and (4) asymptotic security) working simultaneously. It's better than any mechanism including POW - POS - Tendermint - Byzantine Agreement. I am willing to bet we will see a major shift with many dapps moving over and utilizing the SCP. The possibilities are endless if it scales like it should. We shall see.

I have a question. I believe in blockchain, I also believe in the potential of cryptocurrency. But I'm really confused why there has to be a new coin for everything?

Everyone likes to compare this to investing in the internet back in the 90s. But there's only one internet, yes originally there were three or four people trying develop something similar, but not an internet for everything. Why is there a coin for everything? Will there always be a gadzillion coins? Or will there come a time that one coin will rule them all?

To me it seems that all these coins are a scam and that's what scares so many investors away. Thoughts? Ideas? Opinions?

There does not have to be a coin for everything. Over 80% of today's coins are likely to fail. Even some of the current top coin might not be around in a few years. Many coins are not viable based on their formulation and technology, and many are not viable based on the team executing the plan. But a few diamonds are likely to emerge from this period based on the merit behind the technology itself.

The only thing I can understand when reading this article is that you, sir, are much smarter than I am.

Like your post ... and I think your thoughts are very good ...... waiting for your next post

PayPal should consider using blockchain as soon as possible. They should stop wasting people's time with delayed transactions.

PayPal should die in a fire. (They closed my account and will not explain why, and there is no appeal procedure.)

They always do that. They normally claim that the monthly transaction limit had been exceeded.

I am an outspoken activist (with signs) on the streets of Googleville (Mountain View, CA) which is also Yahoo's home. I'd had the account for more than 10 years but the account hadn't had any activity in years. Yet they said the closure was fraud related. We need to get rid of these centralized powers that are able to arbitrarily shut us down.

Oh! Sorry. Decentralization is the way forward to any monetary system whether storage, exchange, formation, etc.

I was trained as a monetary economist. The U.S. had decentralized money in the late 1800's. It was bad. Crypto will be worse. Crypto is here to stay, but none of the current implementations will survive. This opinion is based upon the Sharpe-Lintner capital asset model.

OK. Though here we are talking about global decentralization. Not only one country.

What people don't understand is that network effects are zero for capital assets. A capital asset becomes worthless as soon as the smart money figures out that it cannot sustain itself on the Sharp-Lintner beta efficiency frontier. Bitcoin will likely be the first to collapse. Not hard science. Just slightly informed opinion.

There are also political considerations. The emergence of crypto threatens vital interests of the status quo territorial governments. Those governments have the power and the motive to defend themselves. Private person enthusiasts, OTOH, have no motive to organize and defend this empowering technology, and will not begin to do so until it is too late.

So they put your account on hold till when Jesus comes back on a wooden bicycle.