😏 Tulips, Dotcom, Bitcoin: Why This Time It's Different

What's going on: I'm sure you heard it a dozen, or even hundred times: Bitcoin is like the Tulip Bubble. In the 1630ies some Dutch guys were pretty fascinated by tulip bulbs. Perhaps some rich guy or girl really liked how they looked and were willing to pay a high price for them. So the trade with bulbs began to boom, there was a huge hype. There are rumors that at one point a single bulb sold for the equivalent of $15 million.

This went on for about 3 years, until the bubble collapsed in 1637. It had no critical influence on the prosperity of the Dutch Republic, the world's leading economic and financial power in the 17th century. Some people, who sold their house to buy more tulip bulbs, went bankrupt, but the end of the first recorded bubble had no impact on the economy as a whole.

What's more important is the meaning of the term "tulip bubble". It is used, metaphorically, to describe an economic bubble when asset prices deviate from intrinsic values. Or in other word: Bitcoin is pretty much worthless, so why are people paying a lot of money for it?

Source: twitter.com/naval/

But while most economists tend to tell you that bubbles act the same and I cannot for sure deny, that the whole crypto space looks a whole lot like a bubble, there is something that is very different from all the other bubbles. It's accessibility.

Unlike the Tulip Mania, the South Sea Bubble or the Dotcom Bubble for the first time in history everyone with a basic internet connection (46% of the world's population) has access to this market and / or bubble. Just to put in context: In 2002, the end of the Dotcom Bubble, the percentage was about 10.6%.

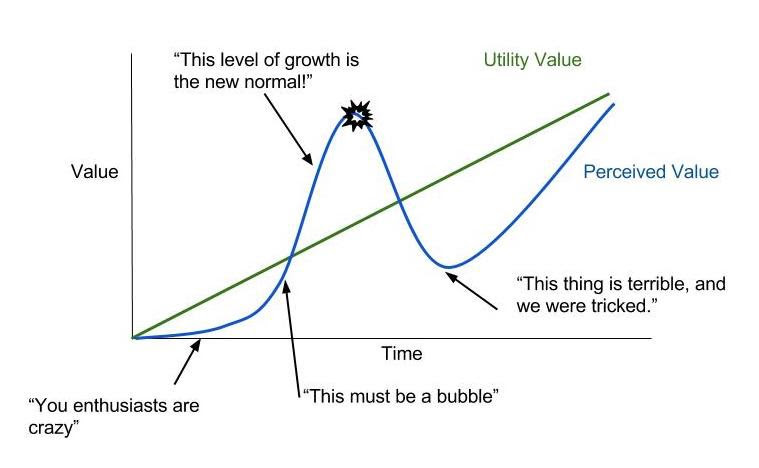

Source: axiomzen.co

Why should I care: The fact that the first time ever anyone who likes and has internet can participate doesn't mean that the crypto market is no bubble. But it means that as more and more people have access to the internet and more and more people accept Bitcoin and other cryptocurrencies as a legitimate investment asset and a revolutionary technology, it might mean that it could turn out to be a bubble one day, but it can take much longer to see it pop.

Source: hackernoon.com

GIF: giphy.com

Want to get essential news on Cryptocurrencies and everything Blockchain for free? Subscribe to Cryptomizer, the daily newsletter with the most essential news on Bitcoin and everything blockchain.